Today we are announcing that HubSpot closed $16 million Series C round of financing. The round was led by Scale Venture Partners on the West Coast with full participation by our great, existing investors, Matrix Partners and General Catalyst Partners. Just as we saw a large increase in valuation on our Series B financing, we saw another large increase in valuation on our Series C financing.

Use of Money

It used to be that you could efficiently grow your businesses by interrupting potential customers with outbound marketing methods like cold calls, email spam, advertising, etc. Today, people and businesses are tired of being marketed to and are getting better and better at blocking marketing interruptions out. At the same time, people and businesses have fundamentally changed the way they shop and learn turning more and more to Google, social media sites, and blogs to find what they want. HubSpot helps companies take advantage of these shifts to help companies get found by customers in the natural way in which they shop and learn using inbound marketing.

We are going to use much of the capital we raised in this round to increase investment in R&D to stay on top of these fast-moving waters for our customers to help them match the way they market their product with the way their marketplace shops and learns. We intend to make our product simpler to use and more powerful for our customers and ensure our product delivers even higher value. In addition to investing in our vision of helping our customers "get found," we will make deeper investments in helping them more efficiently convert visitors into leads and customers.

Uniqueness

We had a lot of interest in the round and in our travels I teased out some things that I think are relatively unique to HubSpot that I thought I'd share.

First, our vision around how traditional, outbound marketing (telemarketing, email spamming, direct mail, etc.) is fundamentally broken was unique relative to other companies in the marketing automation space. Rather than automating and codifying the old rules of marketing, our vision is to transform marketing and then automate the new rules. Our approach is explained in a new book that I wrote with my co-founder, Dharmesh Shah, Inbound Marketing: Get Found Using Google, Social Media, and Blogs. The book, published by Wiley, is officially being released today and is available in Amazon along with every Barnes & Noble and Borders stores.

Second, our 350% revenue growth over the last year and our persistent customer growth through the down economy seemed to stand out.

Third, our iPod-inspired offering also seemed to capture a lot of interest. Rather than create yet-another complicated MP3 player that appealed only to early adopters when building the iPod, Apple made their MP3 player far simpler and integrated it with iTunes and the music. Apple's simple and integrated approach got the non-consumers of MP3 players off the sideline and enjoying this technology. Our product is similarly simple and integrated (SEO, blogging, social media, content management, landing pages, lead management, lead nurturing, closed-loop analytics, etc.) and designed to get the non-consumers of Internet marketing off the sideline and enjoying the benefits.

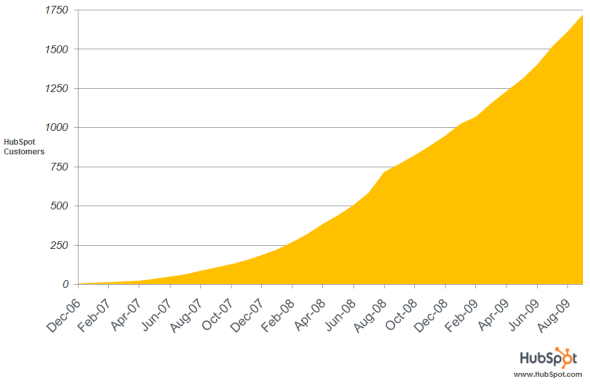

Fourth, with over 1,800 paying customers, we seem to have emerged as the leader in this important new category and many felt we were poised to be the Salesforce.com of marketing. The driver behind the customer traction is the excellent results received by our customers who get a 6x improvement in lead-flow within 6 months of buying our product, on average.

Scale Ventures

There are a couple of reasons why we picked Scale.

When we visited Scale, we started walking them through our SaaS model. We were very impressed with their depth of understanding of the economics and drivers in Saas that went beyond what we heard at other venture funds in our travels. SaaS is still a very new industry, so there are very few benchmarks to look at, but they have had the benefit of investing in Omniture (recently acquired for $1.8billion) and Exact Target which are both very early SaaS players and it was clear they had learned a lot through those investments.

One of Scale's partners is Rob Theis. Rob is an old friend of mine from the time I lived in Asia. I ran the Pacific Rim for PTC and he ran the Pacific Rim from Sun Microsystems. Rob has exceptionally high integrity, he has a personality that meshed well with our existing board which he will join, and he is very well connected in Silicon Valley.

Thank You

I want to take this opportunity to thank several people. First, I want to thank Rob Theis, Ben Fu, Rory O'Driscoll, and the rest of the Scale folks for their new investment.

I want to thank the General Catalyst folks and Larry Bohn especially for their early faith and continued support. Thank you to Matrix Partners for their continued support and David Skok for his wisdom. Thank you to our employees who have executed so well. Thank you to our outside board members, Gail Goodman and Andy Payne. Thank you to our advisors, especially David Meerman Scott. Thank you to the new members of our partner program and the community of supporters building up around our business. Finally, and most importantly, thank you to our 1,800 customers.

Series C Live Webcast

Interested in hearing more about HubSpot's Series C financing?

Join me for a live webcast and Q&A today at noon in the video player at the bottom of this page. Ask questions leading up to and during the live press conference by commenting on this blog post or on Twitter by including @hubspot and the hashtag #seriesc in your tweets.

Note: Below will be a recording of the webcast.

Inbound Marketing Kit

| Learn more about inbound marketing and how to combine blogging, SEO and social media for results. Download our inbound marketing kit. |