6 Tips On Writing a Killer Outreach Email to Investors

"The best way to get a meeting with a VC is to get a warm intro from someone they trust. Cold emails can work too, but they have to be really compelling.”

Chris Sacca, Lowercase Capital

Unfortunately, Chris Sacca is right: warm intros are invaluable. VCs are flooded with cold emails, 75% of which go unopened.

Why? Because a VC’s time is money, and most of these emails are a waste of their time: they’re too long, they’re unclear, they’re irrelevant—or all three.

But cold emails can work if you do your homework and aim like a sniper. Your first step is writing an eye-catching subject headline.

Empty headlines, like “Seeking investment” or “Partnership opportunity,” are headed straight for the trash. If you include key details of your pitch, like sector and funding stage, you will either pique a VC’s interest or get them to a fast no, both of which are ultimately good.

“Inquiry: Pitch Deck”

“B2B SaaS—Lead Secured—Seed”

Once they’ve opened the email. Now you can prove that you’ve done your homework.

Sending 100 copy-pasted cold emails in one hour: 1% conversion rate.

— Sahil Lavingia (@shl) January 25, 2020

Sending 10 unique cold emails in one hour: 80% conversion rate.

Plus you'll have practiced your writing skills, and done more research on the people you're trying to help.

Nothing warms up a cold email like a compliment. You need to do more than address a VC by name: you need to show that you’ve researched their portfolio.

Good intro: “Hi Rachel, I saw your investment in Tapestry (congrats!), so I thought you might be interested in Vector.”

Bad intro: “Hello, Vector is an innovative B2B SaaS company transforming the marketplace.”

Once you’ve proved you’re paying attention, say what you’re building.

“Cold emails should be clear. Avoid jargon and focus on the problem you're solving.”

Fred Wilson, Union Square Ventures

Once you’ve described what you’re building, include evidence that it’s working. This should be a snappy one-liner, not a paragraph.

Bad description: “We’re an AI-assisted tutoring company combining cutting-edge LLMs with RLHF.”

Good description: “We’re bringing AI tutoring to the 50 million students who’ve fallen behind, and we’re growing 50% month over month.”

Bad description: “We’re bringing the restorative power of beneficial lactobacilli to the world.”

Good description: “We’re a female-founded SaaS+ women’s health business, and we’re already partnered with major brands like Sephora and Goop.”

Include quick details, such as seed round, what you’re raising, and what stage you’ve reached, as well as any points of traction. This lets investors know if you are in their strike zone.

Now it’s time to wrap things up.

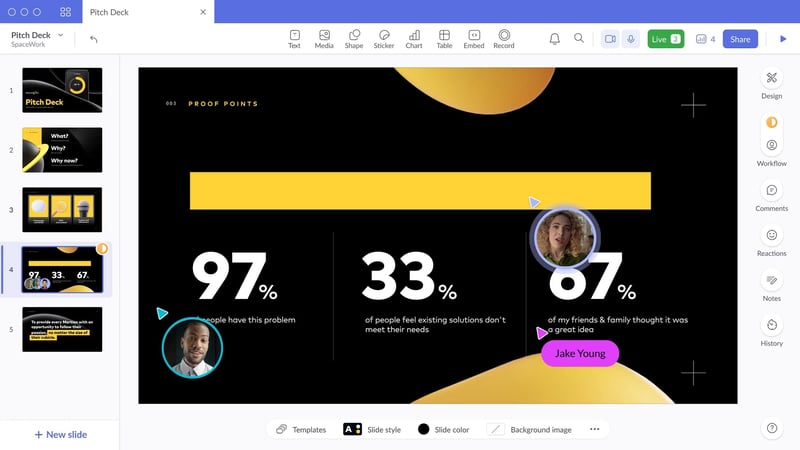

Loom makes it easy to record a pitch of your deck, increasing engagement and making you stand out. Entrepreneur.com estimates that adding video to your pitch deck can increase investment chances by 50%.

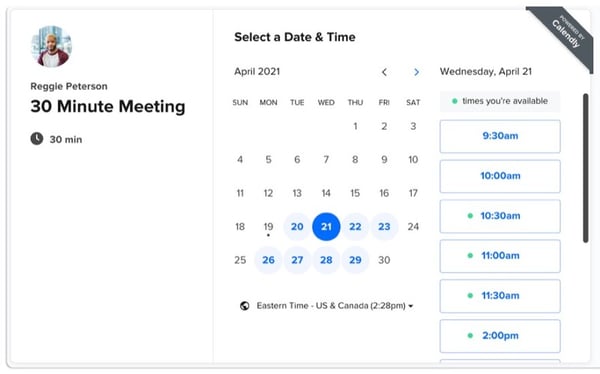

Don’t just tell them you’d like to have a conversation. Always include something like a Calendly link. Make it as easy as possible for them to strike while the proverbial iron is hot.

Sending cold emails sucks. But smart investors know that a good lead can come from anywhere:

Some startups I funded on a cold email:

— Jason ✨Be Kind✨ Lemkin (@jasonlk) August 22, 2022

Talkdesk, worth $10B Today

Algolia, worth $2.25B Today

Salesloft, Vista at $2.3B

Pipedrive, acquired for $1.5B

Look, worry less and just send the email folks

Matt Gore of Optio was a BCG consultant and startup founder with the Saturn Five venture studio. Along the way, he got hooked on crafting stories that help founders raise money and successful ventures. Now he manages OPTIO, a firm that makes world-class pitch decks and sales presentations. OPTIO pitch decks have helped founders raise more than a billion dollars in capital. He is also a partner in several service businesses in Austin, Texas, and leads Aggie Venture Fund, a student-led VC fund at Texas A&M.