This is a guest post from HubSpot for Startups partner Deel.

For startups, the question of whether to go remote from day one is obsolete. Remote working is the most cost-effective, practical, and efficient way to scale. It doesn’t matter whether you plan to hire two remote workers or 2000; the thinking, processes, and execution of remote work management remain the same.

But what about going global from day one?

Going global means pioneering, growing, and operating with multiple marketplaces and sources of talent immediately instead of focusing all of your ideas and capabilities on a single, often domestic market with plans to expand in the future.

Co-working space in Berlin. (photo by CoWomen on Unsplash)

Co-working space in Berlin. (photo by CoWomen on Unsplash)

While the security of the local market can be comforting, it limits your startup’s potential in terms of learning and diversification. Holding back on going global means closing your startup off to larger business opportunities, expanded markets, and global customer bases.

Remote-first startups are uniquely positioned to grow with a global mindset, mainly due to low-overhead costs and greater agility, so why do they hesitate?

The reluctance to go global early on is often due to the preconception that entering a foreign market entails complex, high-risk, and expensive legal processes such as opening a foreign subsidiary, outsourcing payroll, and benefits administration. The technology and infrastructure have since evolved, and so should your approach.

To take the plunge into the global arena and tap into a wealth of international talent, follow these six simple steps:

Step 1: Attract and hire global talent through an Employer of Record (EOR)

The best companies in our global economy view every new hire as an opportunity to enhance competitive advantage through hiring people who add new skills, experiences, and perspectives to their teams. But how do you attract and hire foreign talent compliantly?

Historically, a company’s only option was establishing a foreign subsidiary. However, setup and running fees often exceed hundreds of thousands and require the diligence of legal teams to navigate a complex legal landscape.

London's Canary Wharf subway station. (Photo by Chris Kursikowski on Unsplash)

Today, thanks to innovative hiring methods, startups can build a local presence by hiring remote talent through an employer of record (EOR). An EOR has established entities in countries worldwide and can legally hire employees on your behalf while you retain the day-to-day management.

EORs typically allow startups to send and sign localized contracts, run background checks, and receive visa and immigration support. Many EORs also help by classifying contractors, assuming liability in case of misclassification.

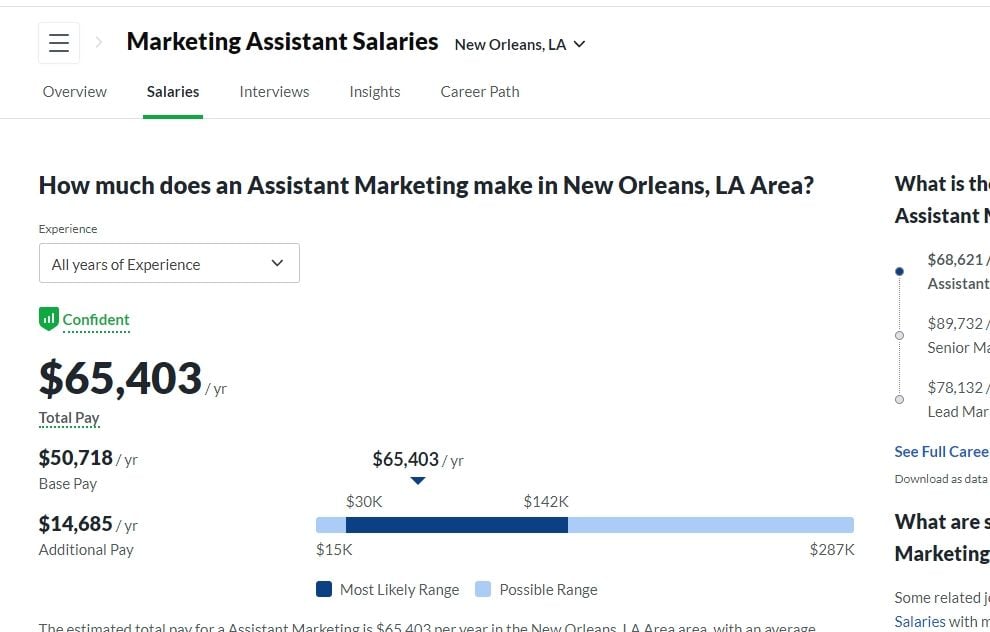

Step 2: Take a global view with your compensation approach

A global compensation strategy gives companies a competitive edge in attracting talent. A comprehensive, high-level approach instead of siloing compensation by country promotes fairness, consistency, and transparency. This strategy helps align your rewards with your business goals and is a key lever to effectively managing a dynamic and global team.

Leveraging technology and data will help you create and implement an informed, competitive, and adaptive global compensation strategy. Use a salary insights tool to view low, median, and high salaries for roles worldwide, giving you valuable insights for designing competitive and fair compensation packages.

One of the most attractive perks startups can offer is equity. Stock options are among the most effective ways for startups and high-growth companies to attract and incentivize top talent, particularly if you don’t yet have the budget to offer competitive compensation.

For legal, finance, and HR teams, navigating equity locally and internationally can be complex, with regulations varying between jurisdictions. With an EOR, startups can directly grant and track equity for employees and contractors on a single platform.

Step 3: Oversee your remote workforce with global-first HR software

Once you’ve compliantly hired your remote talent, it’s time to onboard them and oversee their performance and experience throughout their tenure at your company.

Many early-stage companies onboard their new hires manually, which involves collecting employee documentation, assigning training and onboarding tasks, coordinating equipment, and granting access to software and programs.

Alternatively, startups can invest in HR software to organize and automate aspects of the onboarding process. The problem is many HR platforms have limited functions, cater to single geographies, and can only be used to house employee data. You won’t have visibility in the same system if you want to hire contractors.

Using a global HR platform, you can build country-specific workflows with custom fields for your local and international workers, ensuring compliance and providing a uniform team experience for your workers regardless of their location—no need for separate HR platforms for different countries or to house your contractors.

A global HR platform can centralize and coordinate the following:

- Core HR tasks

- Recruitment

- Equipment provisioning

- Benefits administration

- Visa and immigration support

- Contractor-to-employee conversions

- Equity grants

- Data management and document storage

- Organization charts

- Attendance, time tracking, and time off

- Performance management

- Employee engagement

- Reporting and analytics

- Self-service workflows

- Terminations

- Offboarding

Note: Benefits administration plays a big part in managing remote and globally dispersed teams. Just as your local government stipulates mandatory employee benefits, foreign governments require certain mandatory benefits for all full-time employees.

Before EOR solutions, startups would have to grow their HR department or find a local partner to manage benefits administration. While these experts are well-versed in local standards and requirements, the benefit packages are often rigid and costly when negotiated independently.

EORs often partner with top providers, offering startups exclusive discounts. Using a global platform, startups can:

- Generate contracts that comply with employee benefit entitlements

- Enroll employees in benefits plans

- Manage employee contributions

- Provide flexible workspace memberships

- Provision equipment

- Offer discounts, credits, and rewards

Step 4: Pay your workers in line with local labor laws

The next step to managing your remote startup is to pay your workers in line with the labor laws where they are tax residents. For example, if you’re a UK startup hiring an employee who is a US citizen, you’re responsible for paying their salary and withholding payroll taxes according to US employment standards.

Photo by Mark Boss on Unsplash

Photo by Mark Boss on Unsplash

While paying foreign independent contractors is more straightforward since labor laws do not apply and there is no tax obligation, contractors must also receive payment in the currency where they are tax residents. Hiring companies must select international payment methods, navigate fees, and file the correct tax exemption forms.

Before global EORs, startups had to establish an in-house payroll team with expertise in state and federal tax laws or hire a local vendor. Now, instead of tasking your team to read and interpret foreign employment law, you could use a Global Hiring Guide for your desired country to see country-specific guidance on local employment requirements at a glance, then hire and pay with confidence.

Step 5: Protect your business with international compliance expertise

Compliance is a huge part of managing remote and dispersed teams and is still a significant barrier for many startups. Risk management for labor and tax laws in multiple countries and states requires substantial time and expertise—if employers fail to comply, they risk jail time, bans, and hefty financial penalties.

The most common compliance mistakes startups make when managing remote and globally dispersed teams includes the following:

- Permanent establishment (PE) mismanagement: a tax concept that refers to when a tax agent determines that a business has a steady, continuing, and taxable presence in a foreign country.

- Employee misclassification: illegally categorizing workers as independent contractors when they should be classified as employees. Such misclassification exploit workers and could make you subject to fines, penalties, and back employer taxes.

- Violating local payroll and tax compliance laws

- Violating local data privacy and protection regulations

- Violating intellectual property laws

- Violating labor laws such as minimum wage, overtime pay, paid leave, work hours, rest breaks, pre-hire background checks, mandatory employee benefits, equipment supply, and terminations

- Failing to meet immigration and visa requirements

Before EOR solutions, startups would need to seek legal advice to ensure compliance, especially if they did not have the resources to staff a compliance team. An EOR acts as your compliance department, comprising teams of legal experts trained to stay current on the latest international employment laws and regulations.

An EOR takes care of all the paperwork and assumes legal responsibility wherever you hire so you can focus on business growth. EORs collect and record compliance information, create localized contracts, file taxes, oversee benefits administration, payroll, and HR admin, provide visa and work permit support, ensure compliance with GDPR requirements, data protection and intellectual property agreements, and more.

Photo by Wesley Tingey on Unsplash

Photo by Wesley Tingey on Unsplash

Step 6: Build a globally supportive culture

Only some startups will be successful at remote management—not because they cannot attract and hire the talent, but because the organization’s culture needs to be more supportive across different time zones and work environments.

Managing a virtual team doesn’t require a great deal of management at all. Your job as a founder is to create a flexible and trusting remote culture, provide the right communication and collaboration tools, and allow your workers to manage themselves without the need for face-to-face interaction. Avoid unnecessary hierarchies and micromanaging and embrace asynchronous working to empower remote team members to control their schedules, set deadlines, and deliver the work in alignment with team goals.

For example, all new hires at Deel join a 30-minute virtual orientation during their first onboarding week. The People Manager introduces new hires to the company culture, sets clear expectations around communication, and helps new hires establish clear boundaries and habits to prevent loneliness and burnout and improve work-life balance.

Implementing collaborative tools that the entire team can use streamlines communication and promotes effective collaboration across global teams.

Remote team management resources

Deel is everything your startup needs to manage and scale a remote, international team all in one platform (Deel HR free for startups with fewer than 200 employees). They've provided our readers with some resources.

- Global Hiring Guide: easily determine which countries have global HR support, allowing you to meet local employee and contractor laws and regulations.

-

Global Payroll Guide: Discover how to automatically pay local and international contractors and employees with one click. A global payroll system automatically collects the necessary tax forms, provides multiple currency options, and gives contractors various withdrawal methods.

- Compliance challenges guide: a comprehensive overview of compliance challenges startups face and how to overcome them.