Startup Advisor Agreement Template

Startup advisors play an essential role in new and upcoming businesses. They’re experts in their field and can help startups tackle some of the biggest challenges they may face, from navigating the intricacies of the law to finding a tech stack that works. Even once you've found the right advisor, you will need to decide what they'll be doing and how much compensation they'll receive. That's why having a startup advisor agreement in place is so important.

A startup advisor agreement is a contract between a startup and its advisor. This agreement outlines the terms of the relationship, including the responsibilities of each party and the compensation the advisor will receive.

By the end of this guide, you’ll know what startup advisors do, how much compensation they receive, and what’s included in a startup advisor agreement.

In this article:

A startup advisor agreement is a legal contract that outlines the expectations and obligations between a startup and its advisor.

Advisor agreements are beneficial to startups and advisors alike because they outline exactly what is expected from both parties, the compensation the advisor will receive, and any stipulations surrounding the breach or termination of the agreement.

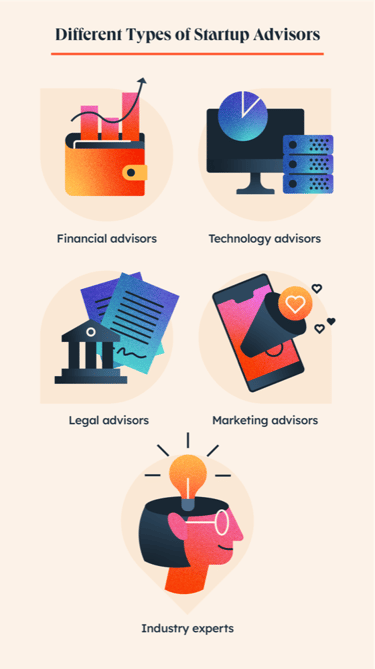

Startup advisors come in all shapes and sizes, but they share the same goal: Keep your business flowing and growing.

Here are a few of the different types of startup advisors you may wish to hire:

Compensation for a startup advisor can vary from business to business, but most commonly comes in the form of advisory shares or cash.

Cash payments are rare and can depend on the advisory role, while advisory shares are more common. The number of advisory shares or amount of cash paid will change depending on the stage of your business and the advisory role.

Advisory shares, or equity, usually come in one of two forms: restricted stock units or options.

Restricted stock units are an allotment of unvested shares of stock. These agreements typically come with some restrictions on when they can be sold. This just means that an advisor may have to hold the stock for a certain amount of time.

Restricted stock units are a valuable tool that helps the startup ensure the advisor will stick around, though it is worth noting that the startup should stagger the vestment period between advisors so they do not all sell at the same time.

Non-qualified stock options are a form of equity derivative that allows the advisor to purchase shares at a later date for a specified price, otherwise known as a strike price.

Options can be an incredible bonus for an advisor, as they lock in a price for a considerable window of time. If a company’s stock price or valuation climbs significantly higher than the advisor’s strike price, for example, the advisor will make the difference instantly.

This can be a mixed bag for startups because it could lead to a huge sale of shares while the company’s valuation is high.

Startup advisors typically get between 0.5% and 1% of the company’s valuation in restricted stock, or between 0.25% and 0.5% in options. Advisors paid in cash typically receive around $90,000 per year.

These numbers are just an approximation and can fluctuate depending on the advisor’s expertise, role, and involvement in the startup. A startup advisor’s compensation can also vary depending on the company's maturity. Generally, advisors beginning earlier in a company’s journey from idea to product development receive more equity.

It’s important to remember that there is no one-size-fits-all formula for a startup advisor agreement, though many contracts may feature similar clauses.

The key is to ensure that the contract meets the specific needs of your startup and that both parties are in agreement with the terms.

Some common elements that are usually included in a startup advisor agreement are:

This is a pretty straightforward piece of a startup agreement that will include the name of the company and the name of the advisor. It will also underline the date the document was signed.

This section, sometimes referred to as “Services” or “Scope of work,” covers what services and responsibilities the advisor is expected to fulfill.

The roles and responsibilities of an advisor will be vastly different depending on the type of advisor with whom you’re signing the contract. Generally, this passage will cover what the advisor will be doing and the frequency at which they are expected to work.

Sometimes advisors will be expected to travel to or attend meetings. This section will clearly state who will be paying for the expenses associated with those events, whether it be fuel, travel, food, or accommodation.

There is no doubt that your advisor will want to be compensated for their work. This passage will summarize how your advisor will be compensated for the services they have provided and the schedule in which the cash will be paid or equity will be awarded and vested.

If your advisor is to be paid in cash, it will typically be a lump sum payment or a monthly or quarterly retainer fee.

More often, advisors are compensated with equity in your startup. This clause will include the advisor’s percentage of ownership and vesting schedule.

The intellectual property rights segment of the agreement will cover the rights over intellectual property that stems from the advisor’s work.

For example, if your advisor contributes to an idea for a successful product, this section will determine whether or not the advisor is entitled to ownership over the idea.Often, an advisor’s idea will be owned by the startup, but it is important to get this agreement in writing to avoid future disputes.

Startup advisors are most often regarded as independent contractors, though this is not always the case and can change over time. The contractor status section may also include an indemnification clause, which can protect your startup from liability if your advisor’s work results in a lawsuit.

While startup advisors are generally considered to be independent contractors, regulations are always evolving. Before making this determination, you should consult with someone familiar with the ins and outs of employment law to ensure that you are classifying your advisor correctly.

This passage will cover the amount of time an advisor is expected to maintain their relationship with the company and how and when either party may terminate the agreement.

Usually, advisor agreements will not specify exactly how long an advisor will work for them, however, many contracts will add a notification period to give the other party a warning before they can terminate the contract. Think of this as a two-week notice.

This section will cover non-compete and non-solicitation clauses, which outline how, when, and if an advisor is permitted to engage with competing businesses.

Because of advisors’ status as independent contractors, non-compete clauses will include an acknowledgment that the advisor can work with other companies but is in full compliance with any other outstanding contractual obligations.

It is also common for startups to include a non-solicitation clause in their agreements with advisors. This clause will prohibit the advisor from using your clients, customers, or contact lists for personal gain.

The conflict of interest section should be clear and concise so that there is no ambiguity about what is expected of the advisor.

If you and your startup advisor are unable to resolve a conflict on your own, dispute resolution terms can provide a road map for how to proceed. In some cases, dispute resolution terms may even require that you and your advisor submit to third-party measures before taking legal action.

Some of the measures you can take before a conflict escalates to litigation are:

Dispute resolution terms are valuable because they ensure that matters are resolved quickly, affordably, and privately.

Now that you have a firm understanding of what to include in your agreement and why, you are ready to dive right into this startup advisor agreement template.

Remember, this is just a template and not all sections or suggestions will apply to your startup. An advisor agreement is an important contract that should be reviewed by your legal team before it is signed.

Advisors can bring the expertise and experience that your startup needs to scale effectively. And an airtight startup advisor agreement can help keep your operations running smoothly and save you from potential headaches.

Now that you have an advisor agreement, you’re ready to take your startup to the next level. HubSpot for Startups can help your business grow by taking the guesswork out of your tech stack. HubSpot for Startups’ partnership program not only gives you a deep discount on the tech tools used by over 150,000 businesses, but it will also give you immediate access to an array of training materials, marketing tools, and much, much more. Schedule your demo today.