How To Create a Startup Financial Statement [Free Template]

A startup financial statement contains financial documents you’ll need to put together when you’re trying to secure funds from lenders. Its purpose is to clearly spell out your startup’s financial health so a lender or investor can assess any possible risk and decide whether or not to offer you a loan.

Typically, traditional lenders such as banks will request documentation like this, but it’s good to have a startup financial statement handy when you’re looking into other types of startup capital, too.

In this post, we’ll go over how to put together a startup financial statement so you can apply for a loan and secure the proper resources for a successful startup.

In this article:

Tip: Make your startup financial statement a living document so you’re always up to date about your startup’s financial health.

A financial statement for startups is a collection of key documents that enables you, your lenders, and your investors to better understand the financial health of your company.

Financial statements highlight things like revenue, income, profit, financial obligations, and the flow of cash through a business and are typically issued on a quarterly, semiannual, or annual timeline. A financial statement is broken into four parts:

For pre-seed or seed startups, a financial statement will likely have more projections than concrete data. For more mature startups, especially post-launch, you can use internal data for your financial statement. These statements are vital when building a financial plan for startup businesses.

A balance sheet is an overview of what the company owns, owes, and the total amount of shareholder equity. There are three primary components of a balance sheet: assets, liabilities, and owner’s equity.

Assets include:

Liabilities include:

Owner’s equity includes:

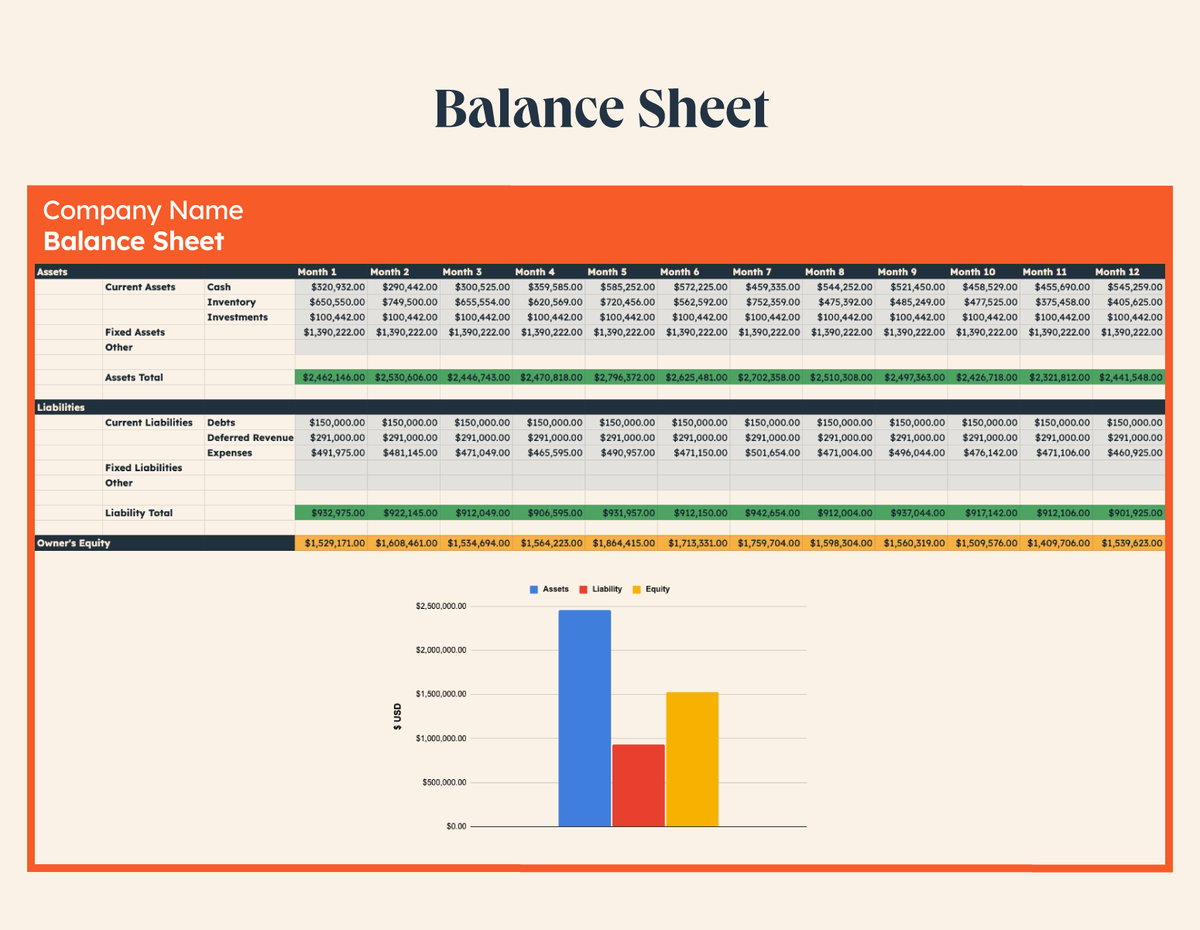

Here is what an example of a balance sheet might look like:

The balance sheet for startups is used to calculate your debt-to-equity ratio. The debt-to-equity ratio compares the amount of debt a startup owes to its shareholder equity.

Balance sheets are important because they can help you have a clear view of what you own and what you owe. This can help you determine whether you’ve borrowed too much money, if your assets are liquid enough, or if you have enough runway to keep the lights on.

Balance sheets are also key in securing startup funding. They help potential investors and lenders ensure that their bet on your company is a safe one. By analyzing your company’s debt-to-equity ratio, they can gain an essential overview of your company’s financial health and creditworthiness.

The profit & loss (P&L) statement section of your startup financial statement breaks down into three primary sections:

Revenue:

Cost of Sales (aka Cost of Goods Sold):

Operating Expenses are all other expenses required for operating the business, including but not necessarily limited to:

Net revenue less total operating expenses gives you net income or losses.

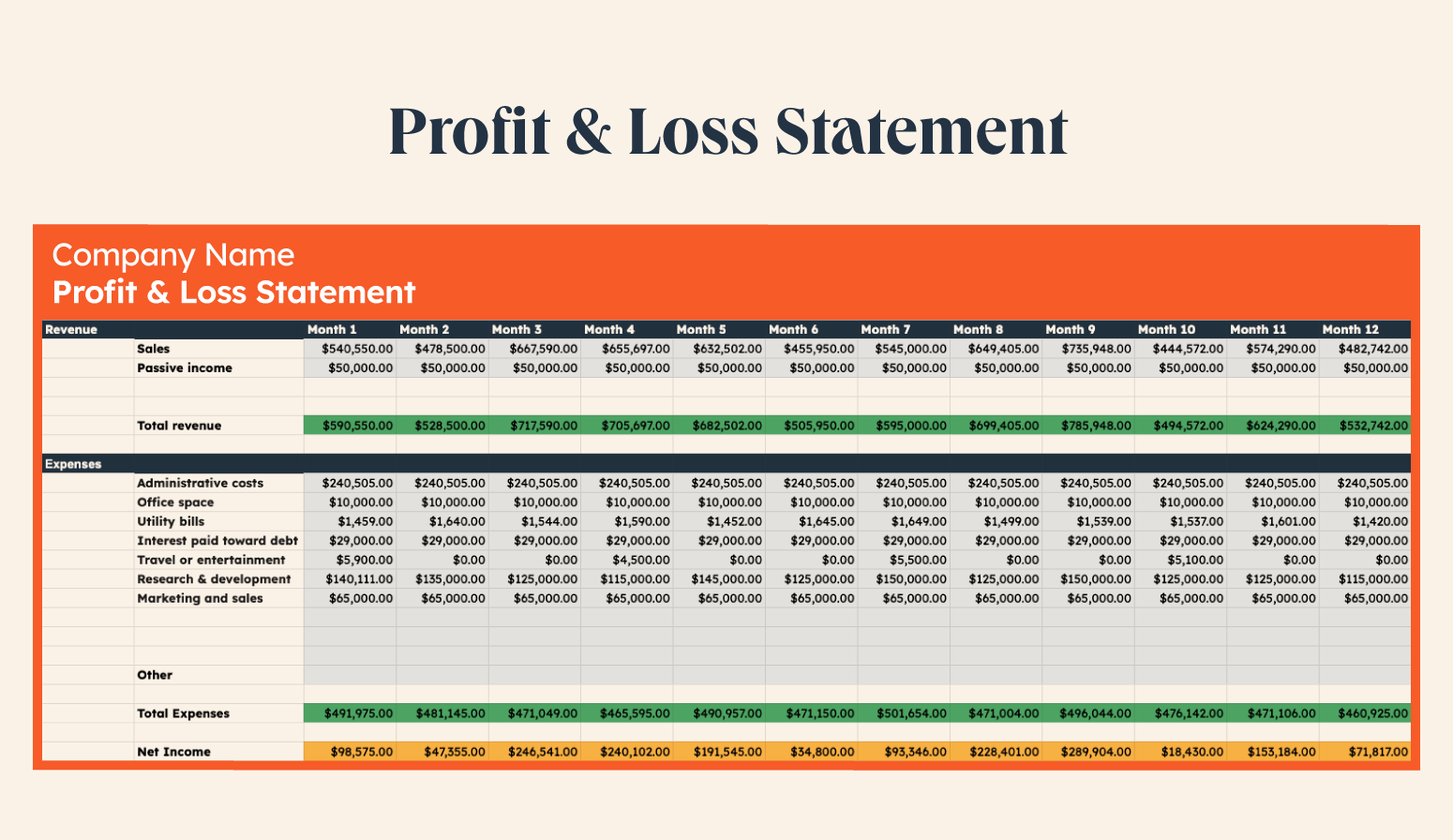

Here is an example of a profit & loss statement:

This data is used for accounting and can help businesses or their investors determine whether certain aspects of the business can be improved or made more efficient.

For example, if administrative costs are growing out of control compared to previous years, your business might consider slowing the hiring process or reducing its salary obligations.

Similarly, if a revenue stream or product is outperforming others consistently, you may choose to dedicate more resources to that product.

As most businesses will use an accrual basis of accounting (vs. cash basis), your net income or loss will not be a reflection of your cash flow. And that is where the next section of your financials comes in.

A startup cash flow statement is a financial statement that highlights exactly where cash and cash equivalents enter and leave your venture.

Cash flow statements are essential to your business because they can help you identify opportunities for improvement in the short and medium term, create crisis management budgets, and gain a better general understanding of your business’s finances.

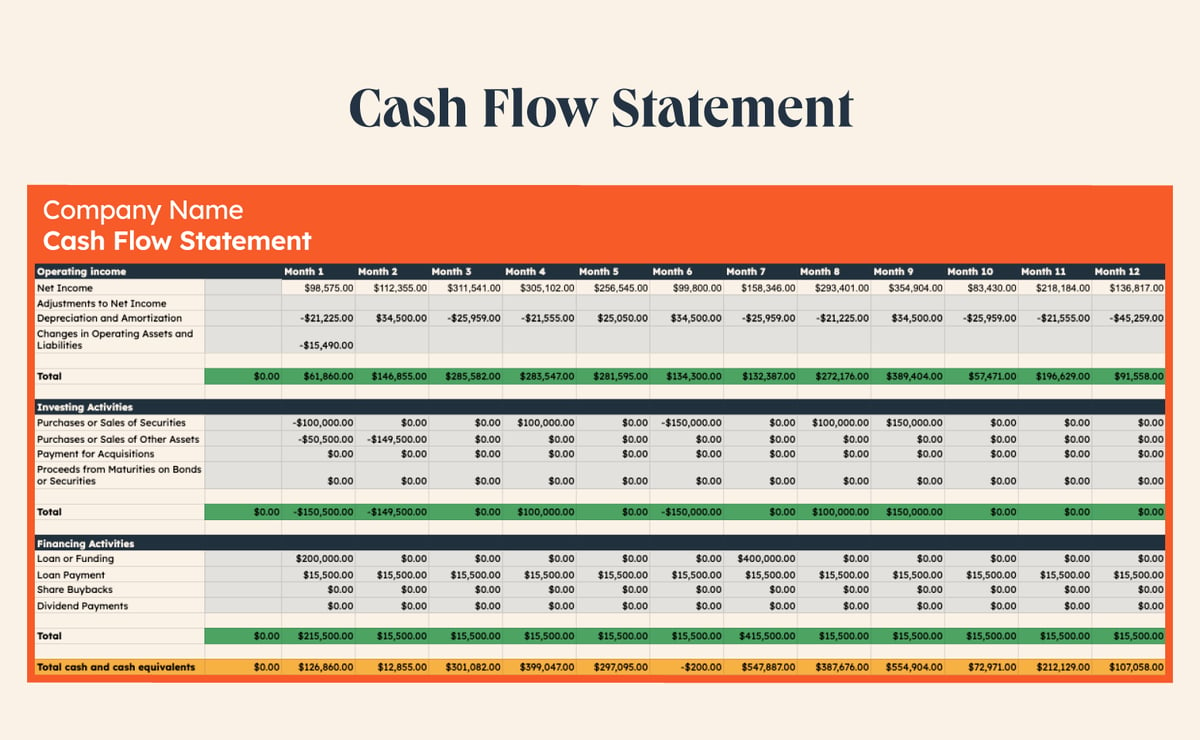

Cash flow statements are broken down into three primary categories: operating activities, investing activities, and financing.

Here are some examples of what to include in these categories:

Operating activities:

Investing activities:

Financing Activities:

Here is what a cash flow statement might look like:

When all of these categories are put together, you will have the total of your cash and cash equivalents.

Keep in mind that this number is not always positive, but that isn’t necessarily a bad thing. Sometimes cash flow can go negative for a period of time as you scale your business or through a particularly rough economic patch; but understanding where and why your cash flow is negative is essential in getting your startup back on track.

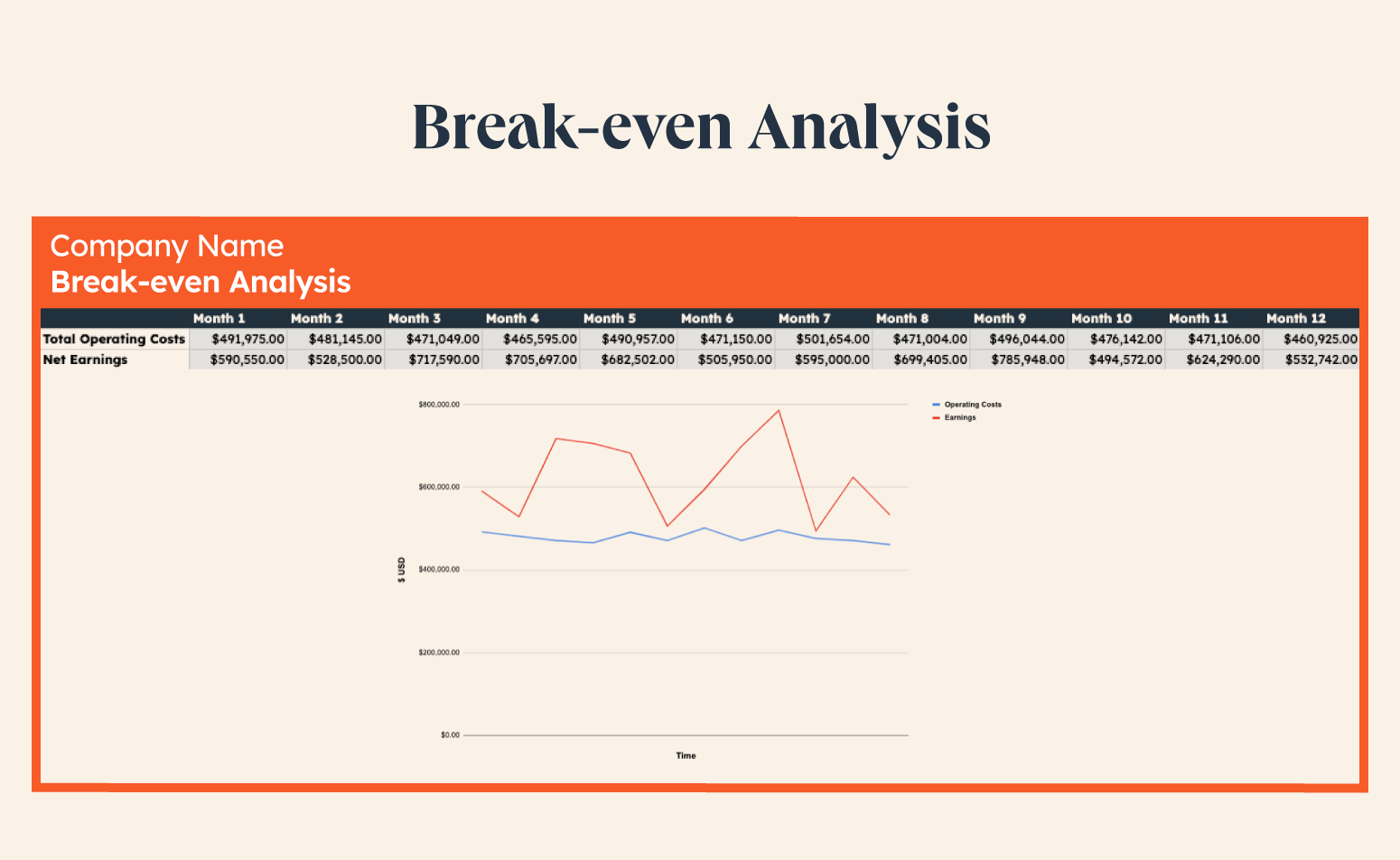

A break-even analysis is a graph that shows total costs compared to total earnings for each product a startup sells. These graphs are relatively simple to put together and very easy to read.

When the line representing earnings is above costs, that’s when the product or service earns enough revenue to cover operating expenses. Break-even analyses aren’t always required for startup financial statements, but they’re helpful for potential investors, lenders, and the startup’s leadership team alike.

Here is an example of a break-even analysis:

Break-even expectations differ from company to company and product to product. For example, if your startup is in the business of selling a physical product, investors' and lenders’ expectations will be vastly different than if you were selling software or services.

Some startups have high upfront costs like research and development or production, meaning these startups may take longer to break even. On the other hand, companies with low startup costs or a large untapped market may find themselves in the green much faster.

Tesla is a great example of a company that took well over a decade to break even. The automaker was founded in 2003 but didn’t reach its break-even point until 2018. The length of time it took for Tesla to break even was largely due to its high overhead costs and limited market.

Apple, however, was profitable within just two years. Launching with just one product, the company was able to keep costs low. By the time it launched its second product, the Apple II, an all-in-one, first-of-its-kind personal computer, sales exploded. The next year, Apple was in the green.

Now that we’ve covered everything a startup financial statement contains, let’s take a look at financial statement examples from three pre-IPO stage startups.

Here are a few links to financial statement examples that may be helpful:

Keep in mind that these startups are already preparing to go public, so their reports may look different than a pre-seed or seed stage startup.

Ready to get started with your startup’s financial statement? Make a copy of our template to put your best foot forward with potential investors.

Any entrepreneur knows you need to spend money to make money. That’s why it’s so important to have your startup financial statement properly prepared for the best chance of securing a loan.

Once you’ve got your funding, HubSpot for Startups helps you take care of the rest. From software integrations to educational resources, we have everything you need to get your startup off the ground.