10 Types of Startup Capital: What You Need To Know

There are many different ways that startups receive funding to launch and scale their business. As good as a product or service may be, startup founders know they need financial support to scale their ideas. Many startups look to traditional types of startup capital, known as series funding. Series startups usually progress through these stages:

There are also non-series funding sources. These usually supplement series startup financing. Some common types of non-series funding that we’ll cover include:

Keep reading to discover what makes each type of capital different and how you can elevate your startup to the next level.

Typical amount raised: $600,000

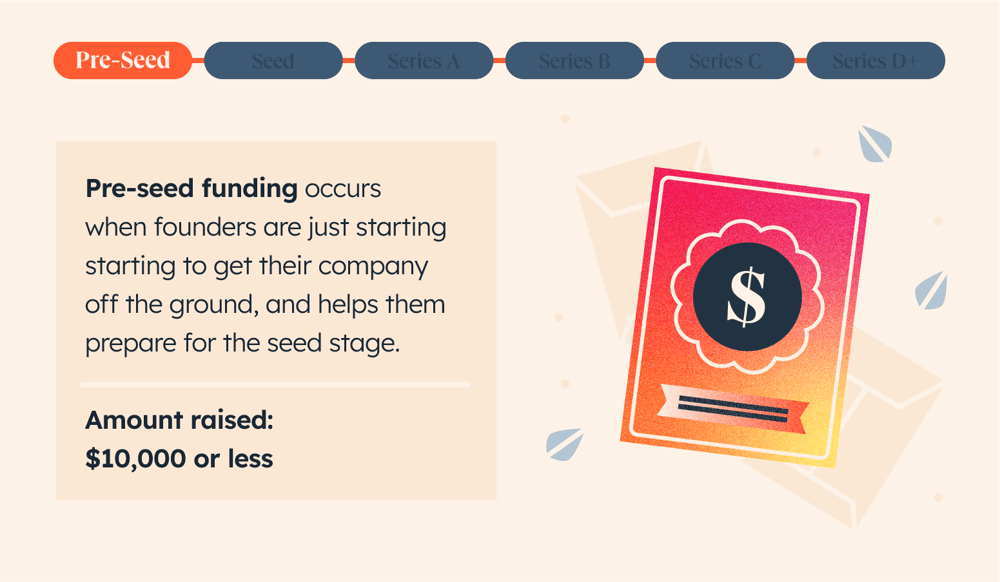

Pre-seed startup capital is the first round of funding for many startups. During this stage, founders are usually still spearheading most efforts at the startup. Founders in the pre-seed stage often rely on “bootstrapping,” or gathering funds from friends and family rather than more traditional funding sources. Pre-seed funding covers the expenses for launching the seed startup.

It can take months to years to secure pre-seed funding. However, in some circumstances — like if funding comes through early — development can happen quickly. Some don’t consider this stage a part of the startup process because it’s mostly preparation work for the seed stage, but pre-seed financing lays the groundwork for a strong base for your startup.

A popular metric for determining if it’s time to expand is burn rate, or the rate at which your startup is spending money before it’s profitable. A higher burn rate can be an indicator that it’s time to proceed to the next stage of series funding.

Typical amount raised: $2.9 million

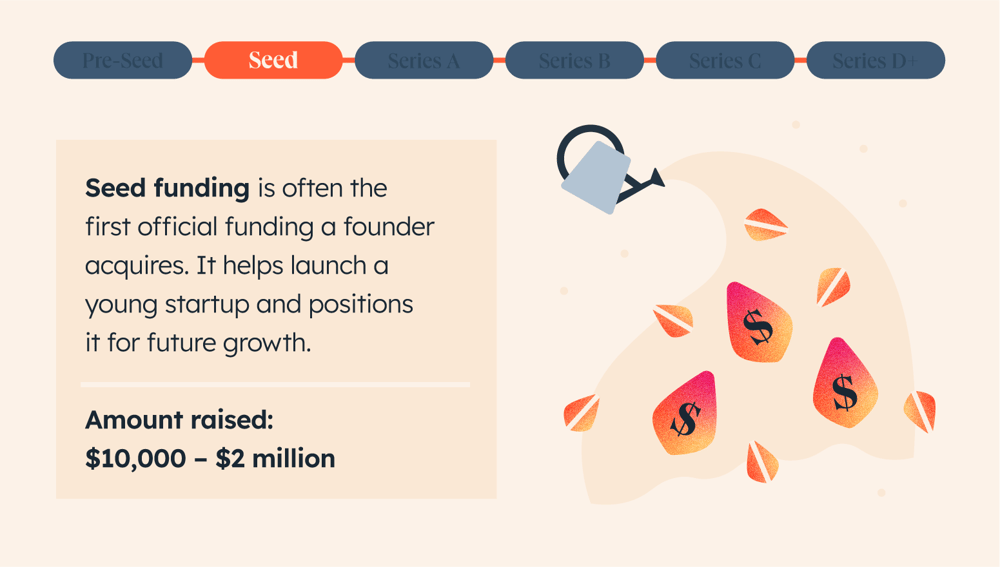

Seed startup capital helps fund market research and product development. During this stage, investors are mostly friends, family, and sometimes venture capitalists. Seed startups raise a median of $1 million. The amount of funds a startup needs during this stage varies depending on the industry, product, or service.

Seed startup financing helps get the seed startup off the ground and positions it for future growth. The majority of startups stay in the seed stage. This doesn’t mean they’re unsuccessful—founders and investors can still turn a profit with a seed startup.

Typical amount raised: $11.6 million

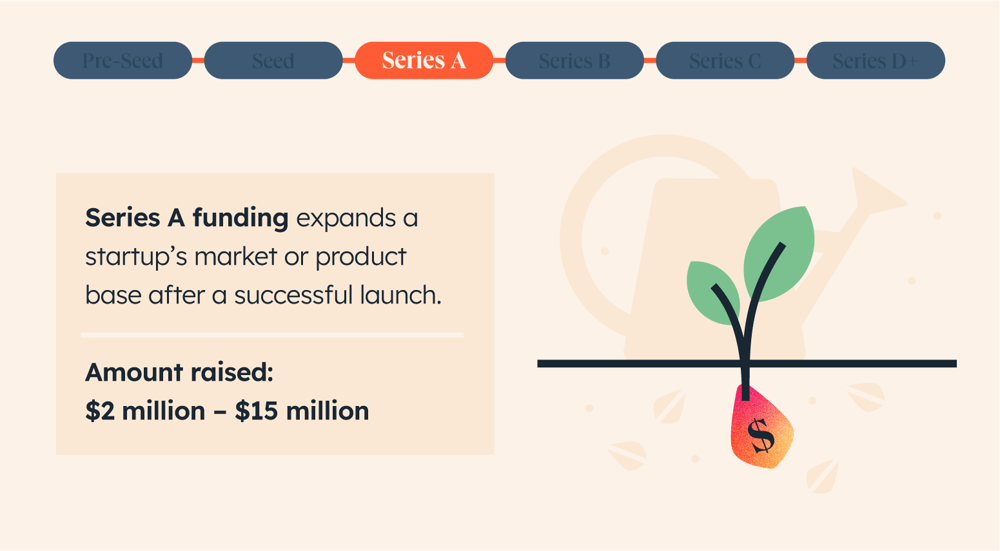

Founders look into Series A startup financing after their product gains a reliable user base and product-market fit. Typically, Series A startup capital supports expanding the startup’s product or target market. With Series A, founders focus on using these funds to maximize the ROI for themselves and their investors.

While these startups typically raise $2 million to $15 million, the median amount raised per investment is $400,000.

Unicorn startups push the average investment amount up — that’s why the average investment amount is $2.7 million. Investors expect a comprehensive business plan when you’re securing Series A startup capital. This plan should explain how they’ll make a significant profit from their investment.

This is also where the infamous “Series A crunch” occurs. This phenomenon refers to when a successful seed startup fails to secure Series A funding.

Typical amount raised: $30 million

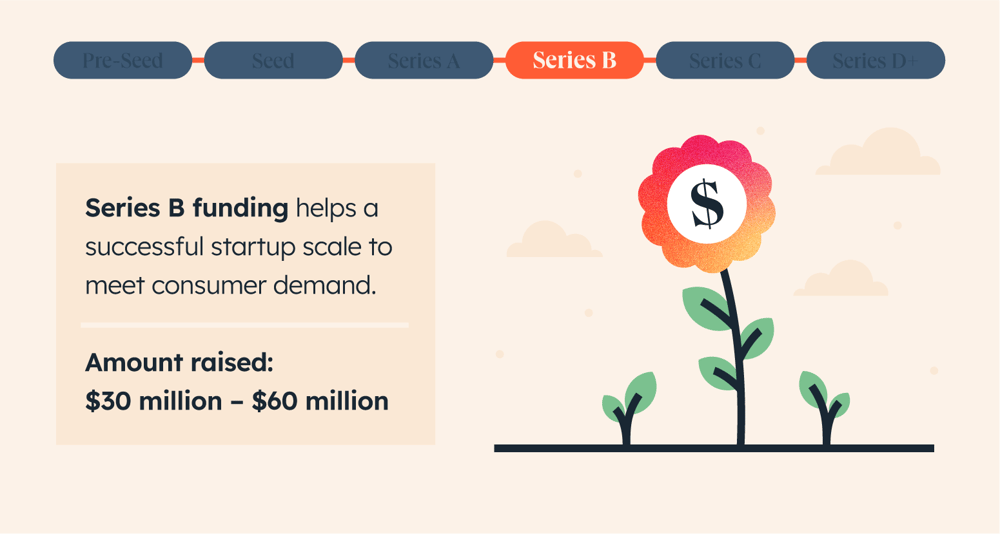

Startups in the Series B phase have a reliable user base and are usually performing well. Series B funds help startups expand to meet rapidly growing consumer demand. In this phase a startup is less risky, but it’s still important to focus on scaling sustainably.

These funds usually cover:

Most startups in Series B will turn to venture capitalists because they need a large amount of startup capital to achieve these goals.

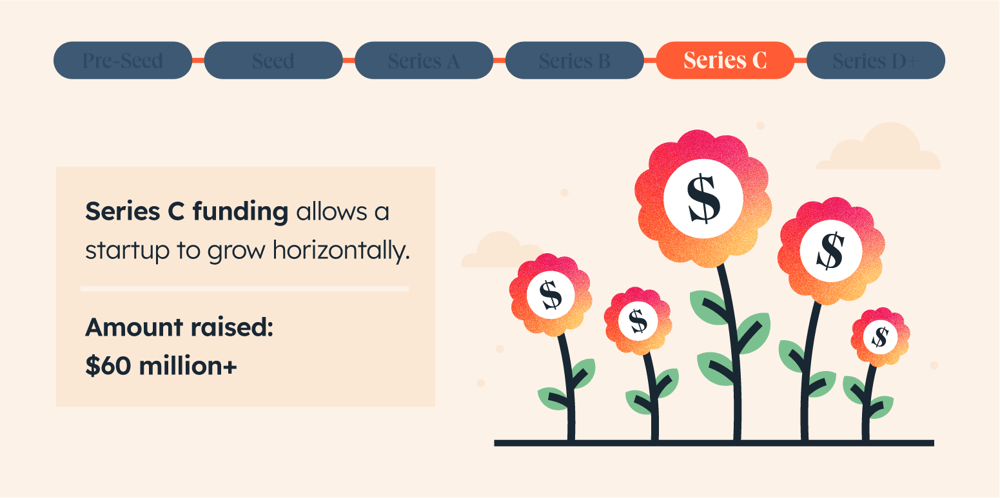

Typical amount raised: $60 million

Series C funding is usually for expanding horizontally, which includes:

Investors expect a large ROI from Series C startups that’s not possible in other startup series stages. Investing at this stage is the least risky, as these businesses have a history of growth and generating revenue.

Typical amount raised: $105 million

While some startups expand to Series D or E, these cases are exceedingly rare. If a startup reaches Series D, this is usually due to a down round — meaning they didn’t turn as much of a profit as they’d hoped in Series C. If a startup moves to Series E, this is generally an alternative to going public.

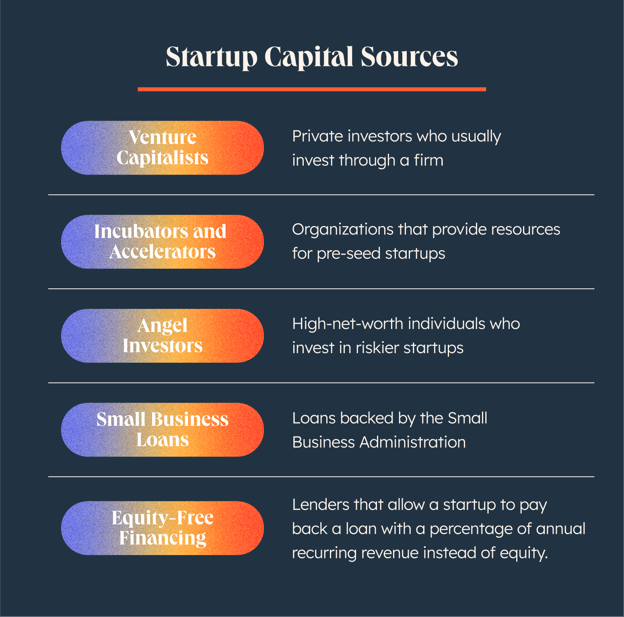

As startups progress from Series A to C, there are different sources from which they can secure capital. The most common sources are:

Startup capital type: Non-series funding

Venture capitalists are private investors. Most venture capitalists work in a firm, where they might consult with other professionals on their investment strategies. These individuals purchase equity in startups and expect to earn exponential profit as the business grows.

There’s always a risk when investing, so venture capitalists generally purchase equity from startups on the cusp of Series A or later. It’s rare for venture capitalists to invest in a startup that’s not ready to launch.

Startup capital type: Non-series funding

Incubators are organizations or companies that work with startups before they’ve launched. They offer widespread resources for startups in the early stages, ranging from physical office spaces to consulting services.

Incubators are usually nonprofits. If you work with an incubator, it’s typically a collaborative environment where many different startups work together for mutual growth and to share industry knowledge.

Accelerators are similar to incubators. They offer similar support and mentorship opportunities for new startups. A key difference is that accelerators are usually paid through equity and work with the startup for a predetermined period.

Startup capital type: Non-series funding

Angel investors are individuals with a high net worth who use their resources to fund riskier startups. This might include startups in the pre-seed or seed stage, but they might invest in more mature businesses as well.

Angel investors usually have some sort of expertise or experience in the industry in which they're investing. Along with funding, angel investors offer advice, business connections, and other guidance to help launch the startup. A key difference between angel investors and venture capitalists is that angel investors take a more active role in growing the startup.

Startup capital type: Non-series funding

A small business loan is a loan backed by the Small Business Administration (SBA) for businesses with 500 employees or less. If your startup meets these requirements, you may qualify for a small business loan:

This type of startup capital offers $500 to $5 million to small businesses. Because the SBA backs these loans, they’re less risky for lenders and give smaller startups a chance to raise funding.

Startup capital type: Non-series funding

As a startup grows, its leadership doesn’t want to sacrifice ownership. When you give an investor equity, they also receive a degree of power over the startup in proportion to the amount of equity.

Platforms like Republic or Pipe are two popular platforms that help source investors in exchange for a percentage of recurring revenue instead. This allows a startup to secure funding without expanding ownership and makes it easier for investors to expand their portfolios. (Note: Pipe is about trading recurring revenue for upfront contracts, whereas Republic is more about investing in startups in exchange for equity, and is open to the public.)

Securing capital is only half the battle when it comes to making sure your startup grows. HubSpot for Startups simplifies everything else by helping startups increase leads, accelerate sales, and streamline customer service — no matter the type of startup capital you’re working with.