The Killer Slide Every Pitch Deck Needs

What do investors want? That’s simple: they want to believe that your company could make them extremely wealthy. Specifically, they want to believe that you can return their entire fund. Yet, too many founders fail to make a simple, clear case for growth.

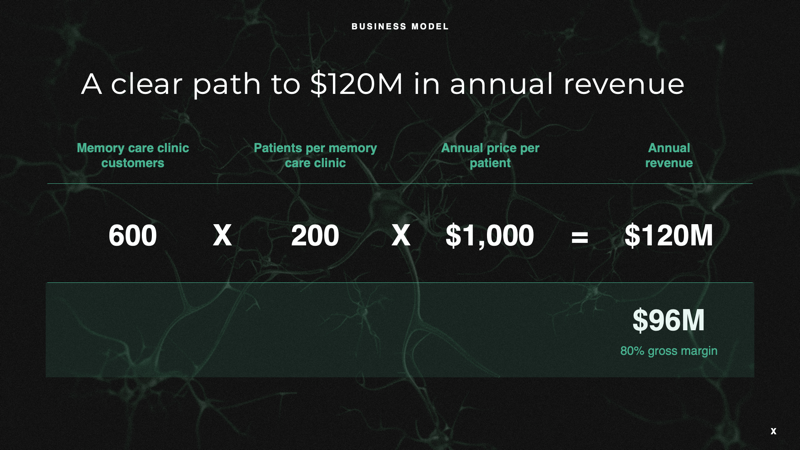

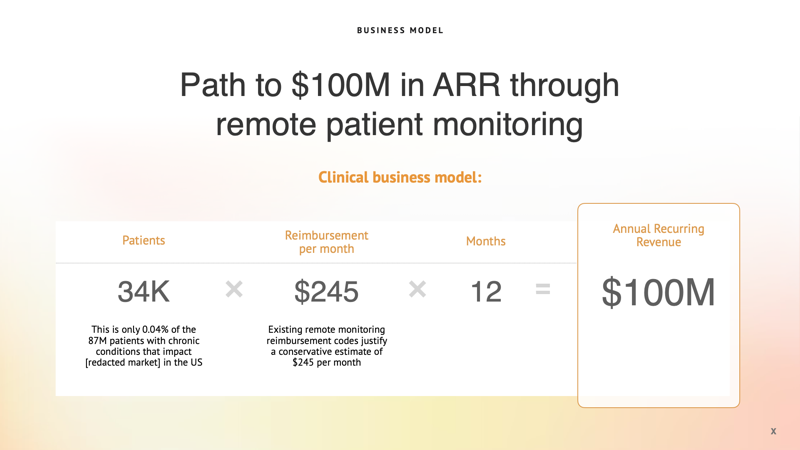

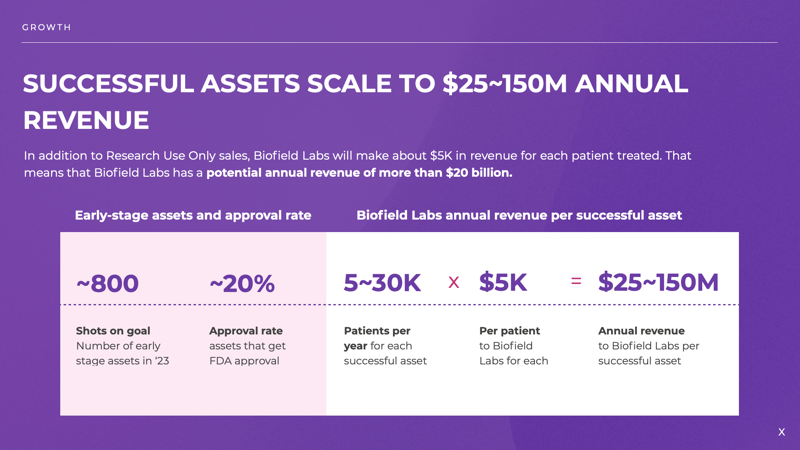

Here at OPTIO, there’s one make-or-break slide that we almost always include in decks: the "How We Get Big” slide. Here, you will demonstrate how you earn money with key specifics like unit economics, LTV, margins, and other financials. Your goal is to combine pricing with market opportunity, illustrating how you can eventually hit scale.

To convince an investor that you have a clear path to making a lot of money, you should clarify your business model and show how it works at scale with a simple equation. Usually, you are showing that with one key assumption (typically number of customers), you can get to a massive revenue number. This dollar amount will vary from company to company, though $100M in ARR is a good spot to be in.

Depending on your business model, your equation might combine unit economics with a percentage of your TAM (total addressable market).

Like your math teacher said: always show your work. The components of your equation need to be clearly labeled and justifiable. For example, you can justify your key customer estimation by explaining how you derived your SOM (share of market) from a larger TAM. You’ll also want to unpack any other assumptions you have made, such as average monthly reimbursements or LTV.

Investors used to look for unicorns. Now they look for decacorns (a company valued at $10B or more).

That doesn’t mean that you should juice your financial projections. After all, most companies will never reach unicorn status. But it does mean you should think about scalability, playing in multiple markets, and a plan that can return the entirety of the investor’s fund. This plan may well change over tim, but it will show investors that you have the vision needed to secure them a great return on investment.

The “How We Get Big” slide does more than show investors that you understand your target market. It’s a place where you can showcase a truly ambitious vision. By elaborating a long-term growth strategy, your pitch will be that much closer to getting investors greedy.

HubSpot for Startups customers are invited to join our new Investor Connect pilot. Unlock exclusive access to unite with global VCs that are ready to hear your pitch and help you get to the next funding stage.

Matt Gore of Optio was a BCG consultant and startup founder with the Saturn Five venture studio. Along the way, he got hooked on crafting stories that help founders raise money and successful ventures. Now he manages OPTIO, a firm that makes world-class pitch decks and sales presentations. OPTIO pitch decks have helped founders raise more than a billion dollars in capital. He is also a partner in several service businesses in Austin, Texas, and leads Aggie Venture Fund, a student-led VC fund at Texas A&M.