Planning a Tech Startup Budget to Keep Costs Low & Results High

Dive into budgeting techniques and real-world scenarios for tech startups, customized for various objectives and sectors.

written by: Paige Bennett

edited by: Ron Dawson

Dive into budgeting techniques and real-world scenarios for tech startups, customized for various objectives and sectors.

written by: Paige Bennett

edited by: Ron Dawson

Getting a tech startup off the ground is more than having a great idea and developing a flashy website or creating viral social media posts. Bringing an idea costs money — and a lot of it.

However, over-inflating a tech startup budget can also be an issue. If you raise too much money too fast, you can end up with a high burn rate and waste money on haphazard ideas or unnecessary office equipment.

So, how do you strike a balance between staying lean and securing enough capital to take your startup to the next level? This guide teaches you how to budget for a startup. You can also find a tech startup budget example and templates to help you get started with budget planning.

Joe Procopio, founder of TeachingStartup.com, wrote for Inc. magazine that startup founders should expect to spend at least $10,000 in the first year of business. United Capital Source reported that entrepreneurs should expect an average of $30,000 to $50,000 in costs for the first year of a new business.

But ultimately, experts agree that there’s no magic number to reach to ensure startup success. Every startup’s story is different, and it will depend on what goals your startup is trying to achieve and what resources you need to meet those goals.

“Estimating a budget for a tech startup is super complex as it varies significantly across hardware, software, industry, and compounded by factors like the competitive landscape and market timing,” Aaron White, CEO of Outbound.com, told HubSpot.

“Estimating a budget for a tech startup is super complex as it varies significantly across hardware, software, industry, and compounded by factors like the competitive landscape and market timing,” Aaron White, CEO of Outbound.com, told HubSpot.

Extensive research into your industry and competitors will be crucial to forming a tech startup budget, and White recommended budgeting for the unexpected, too, to avoid the common startup mistake of going over budget.

“Regardless, I’ve seen that most new startups exceed their initial budgets, a common thing for first-time founders due to unknown expenses that may pop up,” White said. “Whatever the budget ends up being, I always try to include a small buffer to accommodate for some of the unexpected costs.”

While each individual startup budget is unique, there are some common cost categories to budget for, and looking at average costs that other startups have spent in these categories can help founders refine their own budgets.

Here are the average costs for startups based on different business needs:

Many tech startups will opt to have an app for users, but developing an app typically costs thousands or tens of thousands of dollars. According to Business of Apps, developing a simple app costs about $16,000 to $32,000. However, a tech startup may want a more complex app with more functionality and better design, which can drive up the cost from $32,000 to over $100,000.

When it comes to building a successful startup, you’ll need a team of skilled, dedicated people to make your ideas a reality. Founders may find themselves living off of savings for several months, if not years, while getting a startup off the ground. Still, they will need to hire additional people to help distribute the workload and handle different aspects of the business.

Hiring five employees will cost a startup an average of $300,500 in the first year. Some startups may offer lower salaries but with equity compensation, meaning employees get partial ownership in the company. Startups may consider reserving 13% to 20% for an equity pool for employees, with C-suite executives earning around 0.8% to 5% equity, managers earning around 0.2% to 0.33% equity, and junior-level employees earning up to 0.2%.

Another way tech startups can stay lean is to consider hiring people in limited capacities, such as freelance designers to help with logos and graphics, or contracted writers for blog posts or product copy.

“By bringing in professionals on an ‘as needed’ basis for specialized roles, startups can limit the financial burden of full-time salaries and benefits,” White said. “This enables early startups to focus their resources on core competencies and product development, ensuring that capital is allocated efficiently and effectively. This strategy also supports scalability, allowing startups to adjust their use of fractional services as the company evolves, keeping the budget lean and aligned for growth.”

Tech startups obviously need to spend money on tech, but experts have found that many startups overspend in this category. You’ll need computers, software (for everything from sales to marketing to customer service), web and app hosting, and more. All of that can quickly add up to thousands of dollars.

“Don't overspend on infrastructure in the beginning or be tempted by other fancy tools,” advised Binu Girija, CEO at Way.com. “Start smaller, and remember, things can be outsourced in the beginning, like SEO and SEM.”

“Don't overspend on infrastructure in the beginning or be tempted by other fancy tools,” advised Binu Girija, CEO at Way.com. “Start smaller, and remember, things can be outsourced in the beginning, like SEO and SEM.”

Not only is overspending in the tech and equipment category bad for your budget, but it can even limit your company from growing to meet customers’ needs.

“It is our view that brand new companies tend to over-allocate resources to technologies and systems that are scale-oriented,” said Nick Thorne, co-founder of Prehype and Audos. “That is, when companies at this stage invest time and capital to prepare themselves for greater scale, they tend to prematurely optimize. It is not only often unnecessary, but it can, in fact, also be directly harmful by limiting your ability to incorporate feedback as customers provide it.”

A healthy tech startup budget example for a medium-sized startup is about $19,400 for the year, but again, the amount you budget for tech should be enough to pay for the resources you need to meet your company’s specific goals.

In addition to hiring people to help with sales, which can be accounted for in the “people” category, you will need other tools and resources to make sales. For example, you need software that enables you to take payments and a platform or marketplace that can support selling products.

According to Vendux, a startup can expect to budget about 25% to 45% of its revenue toward sales. Ahead of a product launch, the percentage tends to be higher—30% to 45% or more.

Startups should spend about 11.2% of their revenue on marketing and advertising. Marketing and advertising are important for startups because they are new to their market and need to gain attention to ultimately generate leads.

But it’s important not to overspend in this category, especially early-on for a startup.

“One common area where I see tech startups tend to allocate too much of their budget is Public Relations (PR),” White said. “While visibility is key, excessive spending on PR in the early stages can quickly deplete capital.”

Startups may want to utilize AI tools to help craft marketing and ad materials at lower costs in the early stages before they have the funds to hire marketing and ad teams. Social media can also be a cost-effective way to generate interest in your startup when you don’t have much of a budget to spend on marketing or ads.

Startups can expect to spend as much as 15% of revenues on customer support costs, according to HelpLama.

Some cost-efficient options for providing better customer support include developing FAQ pages and thorough product documentation to help customers easily identify and solve problems on their own. A chatbot can also help automate responses to the most common customer questions.

However, customers tend to like to have the option to speak with customer service reps live, so make sure to provide some options, like email or chat, even if your customer support budget is tight.

The investment is well worth it: excellent customer service can boost revenue 4% to 8% compared to competitors.

Startup founders may have the skills to develop a product, create business plans, or even help with marketing, but the startup may not have the money to add an accountant or other essential experts to the team. So, tech startups will need to consider how much to spend on accounting, bookkeeping, and other professional services.

Startups can expect to spend around $1,000 to $5,000 per consultant, per year. This includes rates for accounting services, legal guidance from lawyers, business consultancy, and more. As your startup grows, this figure is also likely to increase.

The amount of money you need to build a tech startup varies greatly. Many successful major companies started with shoestring budgets. One famous example, HP, started with only $538 in 1938 (in today’s money, that’s about $11,460).

Source: HP "history of" infographic

Source: HP "history of" infographic

But other companies start with higher budgets, and for tech startups developing AI products, the upfront cost may be even greater.

“When [Way.com] started, we estimated $500K for the first year. If it's a hardware business, the initial investment can be very high — AI resource costs would be very high,” Girija said.

Ultimately, you have to do a lot of research upfront to get a better idea of what your expenses will be and what revenues you can realistically expect to make in the first year to narrow down a budget for your tech startup.

Calculating a startup’s costs will require adding up all of the fees, subscriptions, salaries, and other expenses you may expect to do business. This will vary from startup to startup. While it is a time-consuming step, it’s well worth the effort you put in. The more thorough you are in your calculations, the better prepared your budget will be.

When calculating the amount of money you need to spend to start the business and keep it running, Thorne recommended thinking of these costs as investments that should net a return on investment in the form of learning or proving your startup. If there are ways to cut down on expenses that don’t contribute to these goals, this can help you weed out unnecessary costs and keep a leaner budget.

“For businesses in their first year, the key learning and de-risking that needs to take place is often: have we correctly identified a problem that customers have? And are we correct that we can deliver them a valuable solution to that problem? While there is massive variation in how valuable a company is when it has validated these two hypotheses, entrepreneurs should be able to answer those questions for less than $1M — and often less than $0.5M,” Thorne said.

Creating a tech startup budget is a very individualized process that will vary from company to company. Whether you’re starting with a few thousand dollars from personal savings or a generous six-figure investment from an angel investor or VC firm, there are similarities in how tech startups can approach budgeting.

“Try not to view your budget on a monthly basis during this period,” Thorne said. “Instead, when you’re getting started, view your budget on a project-by-project basis. Monthly costs have a troubling way of rolling over and eating up your valuable resources.”

You may want to start by setting the budget number based on how much you are absolutely willing to spend and have to spend right away. That could be from loans or bootstrapping.

From there, write out every single cost you can think of that you will need to get the business started or to kick off the next project. Costs may be estimates rather than known figures; if that’s the case, make sure to estimate a little higher to cover any unexpected fees or price increases before you make those purchases.

You can also label expenses based on what needs to be spent early on versus what can wait until later, when you have more revenue or investment money. Finally, make sure to label costs that are fixed, like rent for office space or monthly website and domain costs, and variable, like taxes or payments to contracted workers.

To make planning easier, startups can consider tools like budget templates or even professional consultants to help with setting and following a budget.

When a startup is ready to put together a budget, the most accessible option that won’t eat into said budget is to build a visual budget spreadsheet with a tool like Excel or Google Sheets. Consider both your expenses and how those costs can contribute to increasing profits, which will also affect your budget.

“Build an Excel/Google Sheets model that starts with your costs and then builds to how much of those costs are being invested in acquiring customers and then builds to how much those customers are paying you and finally displays a cumulative cash burn/surplus value,” Thorne explained. “Traditional P&L’s of course start with sales, but sales are an output not an input to the average startup model. Budgeting is about understanding your inputs. It’s worth therefore flipping the orientation of your model.”

While startups can throw together a simple spreadsheet to keep a budget, as you grow, it can become harder and harder to keep a basic budget spreadsheet updated and easy to read with all the additional costs and revenue streams. Using a tech startup budget template, like some of the examples below, makes easier work of tracking budgets, whether short- or long-term.

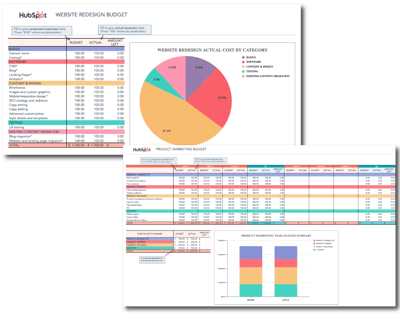

Marketing Budget Templates by Hubspot: This free set of eight budget templates helps startups consider costs for marketing, ads, PR spending, content, and more that will help raise brand awareness and generate leads.

Marketing Budget Templates by Hubspot: This free set of eight budget templates helps startups consider costs for marketing, ads, PR spending, content, and more that will help raise brand awareness and generate leads.We can’t stress this enough: every startup’s budget will look different. Tech startups may be able to reduce costs for office rent and supplies in the beginning by working remotely, but they will need robust technology and digital infrastructure to support their tech products and services. Some startups may opt to go leaner on marketing and advertising costs, instead relying on social media to spread the word, while others find more value in attracting leads through higher marketing spend.

According to the U.S. Small Business Administration, startups should calculate costs for at least one year but ideally up to five years when determining their budgets. SBA even has a worksheet to help new companies calculate these costs.

For a tech startup budget example starting with $100,000, a startup may want to budget the following:

This totals over 100% of the budget, so each startup will need to determine where to cut costs and allocate them to necessary expenses, such as taxes.

After reviewing all your costs, you can see if you are over budget. If so, you can start looking for ways to fill the gap with additional funding, such as venture capital or loans.

Venture-backed startups receive funding from venture capital firms and investors, while bootstrapped startups operate on money generated by the startup’s own revenue and the founder’s own investments. This difference in fundraising can set different expectations when it comes to creating and following a budget.

For venture-backed startups, teams will want to consider “venture capital budgeting,” a practice where the leaders closely weigh the costs and risks compared to the benefits and potential profits for each project before investing. Furthermore, if you raised money based on pitches for specific products, backers will expect money to go toward those pitched ideas.

You may have more creative freedom to put money toward products you feel inspired by if you’re bootstrapping, as you won’t be weighing investor inputs and expectations. But even without investors, startups should always put together a cost-benefit analysis to consider whether an idea or project is viable, or you could risk losing large sums of money. Planning your project budgets with risks and detailed revenue projects can help you better pinpoint which projects are most worth pursuing as you grow your tech startup.

Setting a budget, calculating the most granular costs and expenses, estimating future costs and revenues, and building out spreadsheets or filling in templates sounds like it will take a lot of time — and it probably will. Even if you hire a contracted bookkeeper or work with other professional consultants on budgeting, this process takes time.

But this time is an investment well spent. About 82% of startups fail because of problems with cash flow, such as burning through money too quickly or not maintaining a long enough runway between funding rounds, and these issues are often exacerbated by a lack of time and attention spent on budgeting.

Tech startup founders are pulled in many different directions as the business gets off the ground, but neglecting the budget can be the death of a startup. Spend the time it takes to create a robust, forward-thinking budget, and you’ll be able to more accurately predict revenues and costs, find areas of overspending to cut back and make a leaner budget, plan for unexpected expenses, and even impress investors with thorough budgeting and business planning.

HubSpot for Startups has partnered with Vestbee to help connect the global VCs in our network, with startup founders and entrepreneurs looking for advice on growth, and access to more funding.

Managing your raise can be a challenge, but we're here to help! Complete these steps to add powerful, free fundraising tools to your instance of HubSpot in minutes!

A startup financial statement helps startups secure funds from lenders. It includes a balance sheet, income statement, cash flow statement, and break-even analysis.

A well-written business plan is a critical element for any company looking to succeed. Whether you are just starting your business, or looking to formalize your plans, this template will help get you started.

Financial forecasts rely on your balance sheet, income statements, and cash flow, and our startup financial projections template makes forecasting easier.