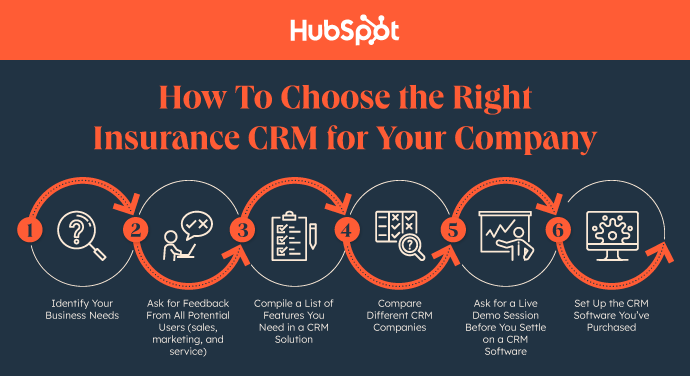

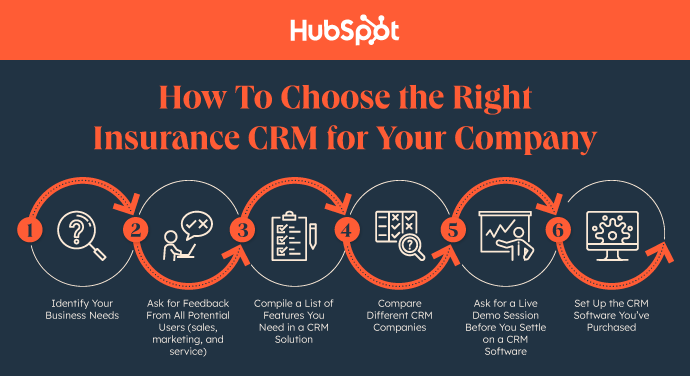

How To Choose the Right Insurance CRM for Your Company

Before choosing a CRM provider, you should consider various factors such as features, pricing, ease of use, and your business goals.

You don't have to go with the most advanced CRM on the market. Instead, choose a provider who best meets your business' needs and aligns with your budget and priorities.

That said, follow the steps below to know which CRM is right for your business:

Identify Your Business Needs

List the company challenges you want to solve to determine which CRM features and modules will be helpful.

Consult your customer service and sales teams to learn about their experiences with customer relationships and customer data. That’ll help you understand how a CRM can simplify their work and improve sales.

A CRM system can help you become more successful when you have clear business goals.

Ask for Feedback From All Potential Users

While the insurance sales team are the primary users of a CRM system, it's important to ask for feedback from all potential users, such as the marketing and service teams, to determine if it'll benefit the whole team.

For example, if your accounting, marketing, and customer support departments will be using the new CRM software, their feature requests will most likely differ from those of your sales agents.

Compile a List of Features You Need in a CRM Solution

After you've identified your business goals and asked for feedback from various teams, compile a shopping list of relevant CRM features.

Ensure the CRM software keeps your data safe with advanced user permissions and two-factor authentications. Other CRM features to look out for include marketing and sales automation, lead tracking, and contact management for monitoring marketing campaigns and sales activities.

It must also have reliable customer support that you can easily access from multiple channels. Choose a provider that offers email, phone, and live chat support to get technical assistance whenever you need it.

Compare Different CRM Companies

When comparing CRM providers, consider the features they offer and how customer-centric and data-driven each one is.

Find out which software will save you money by integrating with your existing marketing automation providers, task management systems, and other third-party software-as-a-service (SaaS) platforms that enhance the CRM's customization and functionality.

Also, choose a CRM tool with features that grow with your insurance business. Or a CRM you can upgrade to a more advanced version should your agency need future changes.

Here are three ways to narrow down your options and decide which CRM tools to test drive:

- Read online and print publications related to your business to understand what CRM software is popular in your industry.

- Ask friends and other business owners what CRM they use and if they’re satisfied with it.

- Check out existing online reviews from customers.

Ask for a Live Demo Session Before Settling on a CRM Software

Most CRM providers offer free trials to potential clients to try the software before buying. An ideal free trial should give you access to all features and enough free trial days to get a complete sense of the product.

Form a trial team of members from different departments that might use the CRM to maximize the free trial. That way, you can collect comprehensive feedback from the end-users — whether they’re in marketing, sales, or customer service.

Set Up the CRM Software You’ve Purchased

After purchasing a CRM that suits your business needs, set it up in a way that’ll be most beneficial to your team.

You can get all the data your team needs from your old CRM, sales emails, or spreadsheets, then integrate it into the new CRM to track future communications between your team and customers.

Grow Your Insurance Company with a CRM

HubSpot CRM offers forever-free plans for its Sales, Marketing, and Service Hubs. As your insurance agency grows, you can upgrade to a premium version with more features.