Understanding Your Partner Commissions

Frequently Asked Questions (FAQ)

General FAQs

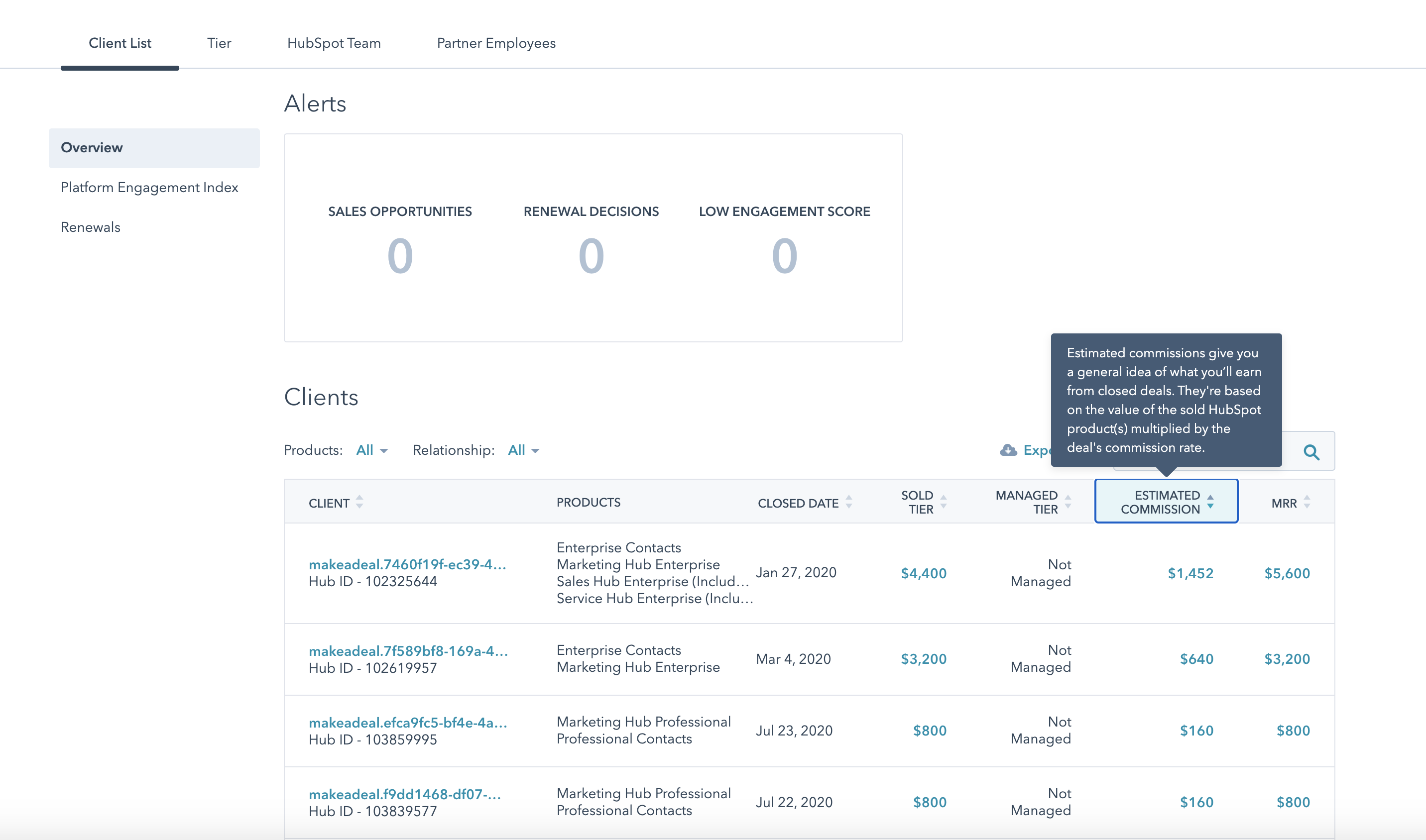

See your estimated commission for each sold account by going to Partner > Dashboard > Client List > Overview and looking at the “Estimated Commission” column.

To determine monthly owed commissions, all deals (or Qualified Transactions, as defined in the HSPPA) are multiplied by their commission rate at the end of each month.

If your client pays in a different currency than what you receive payments in, the commissions will be converted to your payment currency. This is done by multiplying the commission amount by the current conversion rate on the last day of the month.

Estimated commissions give you a general idea of what you’ll earn from closed deals. They're based on the value of the sold HubSpot product(s) multiplied by the deal's commission rate (typically 0%, 10%, or 20%).

Please note that for non-USD client deals, your tier is calculated using a fixed foreign exchange rate to convert them into USD. This means your tier calculation and your actual commission amount may differ if the currency conversion rate at time of calculation differs from the fixed foreign exchange rate used in your partner dashboard. We reserve the right to update estimates at any time.

Yes. We label them as “estimates” because your actual commission may change for various reasons, including client subscription updates, cancellations, accounting adjustments, and currency conversion rates at the time of payment.

Partners are always paid in one currency, regardless of the currency your clients pay in. This currency is determined by the HubSpot entity your partner account was signed under when you joined the partner program.

Possible currencies based on location:

- North, South, and Central America (excluding Colombia) - USD

- Colombia - COP

- European Countries - EUR

- Asian Countries (excluding Japan) - SGD

- Japan - JPY

- Australia and New Zealand - AUD

- United Kingdom - British Pound

- Canada - CAD

There are several reasons why this can be the case:

- We don’t have the proper documentation needed to pay you.

- We ask that you provide the required banking and tax documentation within six months of closing a deal OR within six months of an attempted, but failed, commission payment. If we continue to be unable to pay you due to missing paperwork for over six months, your revenue share will be forfeited. When revenue share is forfeited, the forfeiture is irreversible. Once we receive accurate, complete paperwork you can start receiving commissions on all future qualified deals (as outlined in Section 5 - “Revenue Share and Payment” of the HubSpot Solutions Partner Program Agreement). Please review our Program Policies page for more details about required documentation.

- If you are a VAT/tax liable or Colombian partner, you must provide a required invoice in order to receive your revenue share payment. If we do not hear back within six months of our invoice request, your revenue share will be forfeited on previously sold deals. See the sections below with more information for tax-liable and Colombian partners about invoice submission requirements.

- The deal was not eligible for commissions.

- Partner Assisted is when HubSpot refers a deal to you. Unless the partner and deal are eligible for the Upmarket Referral Program, no commissions will be paid. See our Sales Rules, Program Policies, and the HubSpot Solutions Partner Program Agreement for more information.

- There is a subset of deals that fall into the Upmarket Referral Program, which do qualify for 20% commissions for one year. See more details about this program here.

- We pay commissions for deals you bring to HubSpot (Partner Sourced). Note, shared deals are required to be created and closed to receive credit - see our Sales Rules for more information. If no shared deal is created/closed, no credit will be given. But, we don’t pay commissions on deals that HubSpot reps refer you for (known as Partner Assisted), unless those deals fall into specific programs. Referrals from HubSpot are eligible for Sold MRR credit towards your tier, but not always for commissions.

- The deal is no longer eligible for commissions.

- You closed a deal as a solutions provider more than 12 months ago. Commission expires for solutions providers 12 months after any deal closes. See the “Provider Revenue Share" section of the HubSpot Solutions Partner Program Agreement for more information.

- Your client did not pay their HubSpot bill. Partner commissions are paid out based on what the customer pays us. See Section 5B - “Revenue Share Payment” of the HubSpot Solutions Partner Program Agreement for more information.

- A customer objects to you receiving credit or revenue share for their account. This is uncommon, but if it happens, we’ll email you to make you aware that the customer requested you not receive commissions on their account, and will let you know the date the commissions ended. See Section 4 - “Qualified Transactions” of the HubSpot Solutions Partner Program Agreement for more information.

- You earned a commission as a partner but later moved to the provider program. In the provider program, you receive revenue share for 12 months only. If you have already received 12 months of revenue share or more from the date of the original deal sold date, your revenue share payment will stop immediately on the date of your downgrade to the provider level.

- Deals sold before April 1, 2023 are subject to a legacy plan. Partners will continue to make commissions on deals sold before April 1, 2023 until April 1, 2025, regardless of whether they are managing the client or not. After April 1, 2025, partners can continue to receive ongoing 20% commission on accounts they are actively managing, as designated by Managed MRR credit. If you are no longer receiving Managed MRR credit for a customer, revenue share for that customer will stop.

Commissions are paid quarterly, 45 days after the quarter ends. It may take a few days for any given payment to post after processing.

During the Q1 remittance cycle (May 15), commissions earned in January, February, and March are disbursed to partners. During the Q2 remittance cycle (August 15), commissions earned in April, May, and June are paid, and so on for the Q3 and Q4 cycles.

Note, commissions are not automatically disbursed during the remittance date for potentially VAT/tax-liable and partners located in Colombia. If you are one of these partners, see the sections below for more information about how to receive your revenue share.

Partners are now able to access their commission statements directly in their partner portal. Please review this Knowledge Base article with more information about accessing your HubSpot quarterly commission statements. Note, that you must be an account Super Admin to access the Commissions App.

Commission statements are made available on or shortly after the quarterly remittance date.

To request historical statements that are not already listed in your portal, please submit a ticket in the commissions app of your partner dashboard. Select "I need to request a document" as your Request Type.

To be eligible to receive commissions, you must submit the appropriate and correct documentation through your partner account, and it must be accepted by HubSpot.

For most partners, that simply means providing a completed bank form and tax wizard/form via your partner portal.

There are some additional requirements for potentially VAT/tax-liable and Colombian partners. If you are one of these partners, see the sections below with more information about how to receive your commissions from HubSpot.

Partners are responsible for the submission of required documentation in order to receive commission payments from HubSpot. If the required and correct documentation is not submitted within six months immediately following the close of a qualified transaction, you are no longer eligible for revenue share. Forfeiture is irreversible.

For more information regarding revenue share and payment, please review the HubSpot Solutions Partner Program Agreement. For more details about required documentation, please visit the HubSpot Solutions Partner Program Policies webpage.This could be due to a number of reasons. Some possible ones include:

- Missing or incomplete bank and tax forms required for payment

- Missing paperwork or improper/incomplete process followed when attempting to change the business name on your account

- There was a failure with your bank account, requiring an update to your banking info

- HubSpot has not received the required invoice if you are a potentially VAT/tax-liable partner or a partner in Colombia

Please submit a ticket in the commissions app of your partner portal for more information about any missing payments.

An authorized partner Primary or Billing contact will need to submit an updated bank and/or tax form via your partner portal. Step-by-step instructions can be found in this Knowledge Base article.

If a provider upgrades to the partner level, any deals/product lines originally sold at the provider level will remain limited to twelve months of commissions. At the partner level, you can earn revenue share for up to three years on any new product lines sold to a customer, assuming all appropriate sales rules are followed.

2023 Commission Changes

The duration of the revenue share term for new deal MRR is changing from 20% customer lifetime to 20% for three years, for all deals sold on or after April 1, 2023. That includes all deals that are eligible for commissions today:

- Qualifying new customers

- Cross-sold customers

- Customers upsold from starter.

Please note that three years is the maximum period. If a customer churns sooner your revenue share will stop.

For deals sold prior to April 1, 2023, HubSpot will continue to pay 20% commission for two years, until April 1, 2025, regardless of whether you are managing the client or not. After April 1, 2025, partners can maintain their legacy commissions on these deals as long as they are getting managed MRR credit for that customer according to the updated managed MRR criteria, which includes the removal of workflows for credit and shortening of the window from 90 days to 60 days. See the Knowledge Base article for more information about managed credit.

We’re changing the criteria for untiered partners in order to maintain prestige in the program. If a partner joined the program before January 17, 2021 and is currently untiered, they will have until July 15, 2023 to reach the gold tier to stay in the program. Otherwise, they will be moved to the Provider level unless the partner explicitly asks to be removed from the program. When partners downgrade to the provider level, all commissions are reset to a twelve month duration. If a Partner has already been paid revenue share for twelve months or more at the time of the downgrade, the Partner’s revenue share will stop immediately upon downgrade

Moving forward, untiered partners will have two years from their join date to tier up. We will evaluate all untiered partners who have hit their two-year tenure during each recalibration and provide them notice to tier back to gold. If not gold by the end of the six months, they will be given the option to move to the provider level or exit the program. Gold partners who downtiered on January 18, 2023 will be exempt from this new policy until the January 2024 recalibration process, unless they tier back up to gold or above. To learn more about the recalibration process, visit the How Tiers Work page.

There’s a new “Upmarket Referral Program” which provides a 20% one-year, co-selling commission, starting February 17, 2023. Platinum, diamond, and elite partners who have achieved a CRM Implementation Accreditation may be eligible for 20%, one-year commission when they help close and service certain types of upmarket deals that are referred to them by our direct sales team. See the Sales Rules page for more details.

Lastly, HubSpot is exploring paying for servicing in the future. We have started gathering additional data for the design of this program and are planning to test out an initial concept this year.Duration of Commissions

For deals sold before April 1, 2023, HubSpot will continue to pay 20% commission for two years until April 1, 2025 regardless of whether or not the partner is managing the customer and as long as the customer maintains an active HubSpot subscription. After April 1, 2025, if a partner continues to manage that customer and has managed MRR credit, HubSpot will continue paying 20% commission ongoing for that active HubSpot customer.

Managed MRR requirements

There are three key changes to managed credit:

- We made an improvement to use “real-time data,” which means there is no longer a lag between your action in a client portal and what counts towards managed MRR.

- Effective April 3, 2023, workflows will no longer count towards managed credit.

- Effective April 3, 2023, we’re reducing the managed MRR window from 90 days to 60 days.

New Commission Policy

Starting April 1, 2023, HubSpot solutions partners will be paid 20% for three years from the sold date when selling to new customers or cross-selling to existing customers. If the customer ends their HubSpot subscription, the commission also ends.

The intention of this program is to compensate partners who invest significant internal resources to co-sell complex deals that HubSpot direct reps refer them to for their servicing expertise. The program has requirements for both the partner and the deal to qualify.

Some partners may qualify for the new HubSpot Upmarket Referral Program, a new program where certain partners are eligible for 20%, one year commission when they help close and service upmarket deals that are referred to them by our direct sales team. This is ONLY for eligible partners and takes effect on February 17, 2023.

Partner Criteria:

- Platinum, diamond, or elite tier partner

- CRM Implementation Accredited partner. If the accreditation is not yet available in your language, you may be exempt from this requirement. See accreditation application details and apply here. Close to being accredited? Talk to your PDM.

Deal Criteria:

- The deal size must be $3,000 or greater for a Professional or Enterprise subscription.

- New and existing customers to HubSpot (this includes upsell or cross sell into the HubSpot install base)

- Your customer must sign the POI (proof of involvement)

- The deal is logged by the Growth Specialist as a shared deal and is submitted for deal credit when the deal closes

Untiered Partner Changes

Yes, this will occur every six months during the tier recalibration process in January and July. All partners will have two years to reach gold tier status; if they do not do so, they will be moved to the Provider level unless the partner explicitly asks to be removed from the program. When partners downgrade to the provider level, all commissions are reset to a twelve month duration. If a Partner has already been paid revenue share for twelve months or more at the time of the downgrade, the Partner’s revenue share will stop immediately.

When partners downgrade to the provider level, all commissions are reset to a twelve month duration. If a Partner has already been paid revenue share for twelve months or more at the time of the downgrade, the Partner’s revenue share will stop immediately upon downgrade.

If a partner exits the program due to not meeting the new partner tiering requirements, their commissions will be terminated as of the exit/termination date. This means that they will stop earning commissions as of that date. HubSpot will make one last payment to the partner post the exit date for any revenue share earned up to the exit date.

Once moved to the provider level, you can rejoin the partner program anytime, but you must reapply and go through onboarding again. Once you rejoin, your two years to get to gold restarts.

Deals sold as a provider will earn 20% revenue share for one year, and deals sold going forward as a gold tier partner will be 20% revenue share for three years.

If a partner is located in a region where Onboarding Foundations is available, they will be required to purchase that again. If not, they will be required to purchase traditional onboarding at a 50% discount. Once a partner rejoins the partner program, they will be required to purchase the minimum cost of participation.

Miscellaneous

No. The changes in commission duration do not impact which deals are qualified for commissions.

Tax-liable Partner FAQs

Commissions paid by HubSpot Deutschland GmbH, HubSpot France, HubSpot Ireland Limited, HubSpot United Kingdom, HubSpot Netherlands, and HubSpot Spain to a partner located in Germany, France, Ireland, United Kingdom, Netherlands, and Spain may be subject to VAT/GST (tax) because both the partner and the HubSpot subsidiary are located in the same respective country.

To ensure compliance in the countries we operate in, HubSpot requires the submission of a tax invoice in order to claim your partner commissions every quarter.

If you are a partner located in one of the countries listed above, you may be tax-liable and are therefore subject to the invoice document requirement in order to receive payment of your commissions.

To ensure compliance in the countries we operate in, HubSpot requires the submission of a tax invoice in order to claim your partner commissions every quarter.

Once your invoice is submitted, reviewed and approved for accuracy, the payout will typically occur within ten business days.

To receive your commissions every quarter, you must submit a VAT/GST invoice. Please take these three easy steps.

1. Create a VAT/GST invoice using HubSpot's quarterly commission statement.

- The invoice should:

- Be addressed to the HubSpot subsidiary located in the same country as your business. For example, if you are located in France, your invoice will be addressed to HubSpot France.

- Include all customer commissions earned in the quarter being invoiced.

- Only have VAT/GST applied on customer commissions subject to VAT/GST.

- For compliance purposes, whether or not your commissions are subject to VAT/GST, HubSpot requires an invoice to issue payment. So if your commissions aren't subject to VAT/GST, then 0% VAT should be denoted on the invoice.

Please consult your local tax authority or a tax expert if you need further guidance on the applicability of taxes to your revenue share in your jurisdiction.

2. Submit your VAT/GST invoice to Partner Ops for review and approval.

-

Invoices should be submitted via a ticket in the commissions app of your partner portal. Select “I need to submit a document” as your Request Type.

3. Receive your payment.

- Once reviewed and approved for accuracy, the payout will typically occur within ten business days.

Please ensure the timely submission of your quarterly invoice to avoid delay or forfeiture of your revenue share payment.

Invoices should be addressed to the HubSpot subsidiary located in the same country as your business. Please see list below for all countries:

HubSpot Ireland Limited

1 Sir John Rogerson's Quay

Dublin 2, Ireland

HubSpot Germany GmbH

Am Postbahnhof 17

10243 Berlin, Germany

HubSpot France S.A.S

91 Boulevard Haussmann

2nd Floor

75008 Paris, France

HubSpot UK Holdings Limited

5th Floor, City Bridge House,

57 Southwark St, London,

SE1 1RU

HubSpot Netherlands B.V.

Tribes Amsterdam Raamplein

Raamplein 1

1016 XK Amsterdam, the Netherlands

HubSpot Spain S.L.

Paseo de la Castellana 91

10th Floor P2

28046, Madrid, Spain

We are not able to give you specific tax or legal guidance on the amount, rate, or applicability of tax to your revenue share payments. Please consult your local tax authority or a tax expert if you need further guidance on the applicability of taxes in your jurisdiction.

Colombia Partner FAQs

Commissions paid by HubSpot Colombia to a partner located in Colombia are subject to tax withholdings.

Therefore, to ensure compliance in the countries we operate in, HubSpot utilizes a third-party supplier to issue payments to partners in Colombia. Aside from providing HubSpot with required documentation (detailed below), partners in Colombia must also submit an invoice to our third-party supplier. Once all required documentation is received and approved, the payout will typically occur within fifteen days. Please note, it may take a few days for any given payment to post after processing.As a partner located in Colombia, a few documents are required in order to receive your commissions from HubSpot:

- Bank form (submitted via your partner portal)

- Tax wizard/form (submitted via your partner portal)

- To comply with anti–money laundering regulations (SAGRILAFT) and the Business Transparency and Ethics Program (PTEE), HubSpot carries out processes for onboarding and updating information of the third parties it works with as part of the due diligence required by law. This takes place during onboarding, every two years, or whenever deemed necessary.

- You must submit your RUT and Bank Certificate, along with any other requested documentation, through a form you will receive by email.

- A social security payment document (if applicable to you, submit a ticket in the commissions app of your partner portal. Select “I need to submit a document” as your Request Type).

Additionally, every quarter, partners in Colombia must submit an invoice to 901183491@factureinbox.co with tax applied on the commissions earned in that quarter. If you are a partner submitting a social security payment document, you will instead need to submit a ticket in the commissions app of your partner portal. Select “I need to submit a document” as your Request Type.

Please submit a ticket in the commissions app of your partner portal to contact us for more detailed information about invoice requirements and how to submit your invoice.

HubSpot cannot provide guidance on how to apply tax on your revenue share payments. Please consult your local tax authority or a tax expert if you need further guidance on the tax payment obligations applicable to you.

Payments are issued by our third-party supplier, so exact payment dates cannot be provided.

However, if all required documentation, including an invoice, is submitted and approved before the 20th of the month, as confirmed by our third-party supplier, payment should be expected on the last business day of the same month.

If you do not receive an immediate confirmation from Facture in your inbox, check your spam folder. If the email is not found anywhere, please submit a ticket in the commissions app of your partner portal.

Unfortunately, due to system limitations, we are not able to proactively notify you when your invoice has been approved.

If you have submitted your invoice and are still waiting to receive your payment weeks later, please submit a ticket n the commissions app of your partner portal.

Japan Partners

As a partner located in Japan, you may be subject to the Japanese Consumption Tax (JCT). To comply with new QII requirements that go into effect on October 1st, 2023, HubSpot requires the submission of an invoice (or confirmation that JCT is not applicable to you) in order to claim your partner commissions every quarter.

Once your invoice is submitted, reviewed, and approved for accuracy, or we receive confirmation that an invoice is not required, the payout will typically occur within ten business days.

The invoice should include:

- Your partner name

- The quarter being invoiced

- The correct pre-tax amount (the “total commission payment” amount on the commissions’ statement)

- Your JCT tax rate (10% or 8%)

- Your 13-digit QII number

- The date the invoice is being issued

- The invoice should be addressed to HubSpot Japan KK: Marunouchi Eiraku Building 26F, 4-1 Marunouchi 1 Chome, Chiyoda-ku, Tokyo 100-0005, Japan.

Submit a Ticket

If your question has not been answered above, or you need to send or request a document, please fill out the form below. Once you submit, you’ll receive an email with the details and expected response time. Please allow up to five business days for a response.