-1.jpg?width=3580&height=3198&name=Brandon%20(3)-1.jpg)

Brandon Smithwrick

Content Strategy

This Forbes 30 Under 30 entrepreneur and former Head of Content at Kickstarter has shared his strategies and tips with the masses. Published in Hypebeast, AdAge, Complex, Highsnobiety, and AdWeek.

Guides

Discover the strategies shaping 2025 and how data-driven decisions are redefining success.

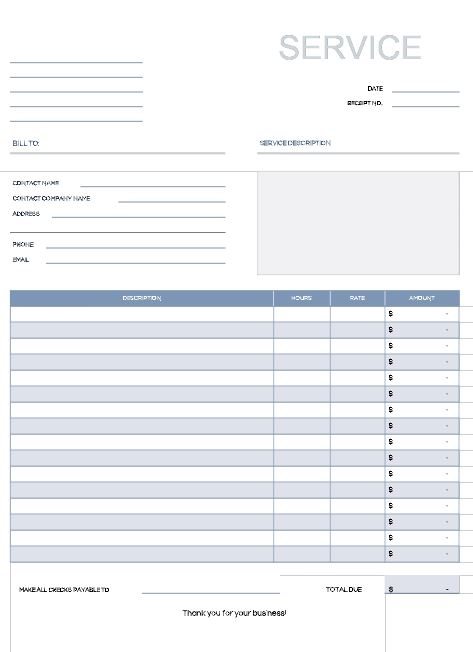

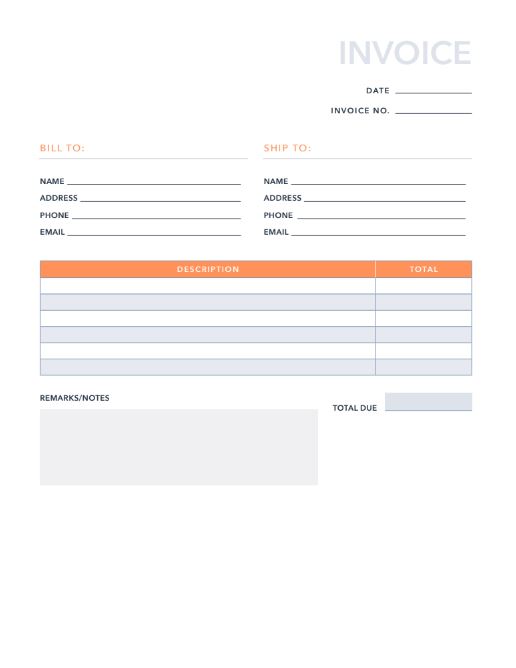

Template

Track the success of your latest marketing campaign with our marketing dashboard template.

Kit

Maximize your marketing impact with minimal resources using this collection of battle-tested AI prompts.

Template

Google Sheets

Identify early signals, anticipate objections, and position your solutions effectively in an AI-disrupted market.

Guides

Access to a script template and objection handling responses that top-performing SDRs use to book meetings.

Kit

.png)

This guide shows you how to prompt ChatGPT to write personalized, response-worthy emails that get replies.

Guides

This free guide walks you through a 5-step AI-powered process to extract, analyze, and apply customer insights.

Template

Excel

Take control of your customer loyalty metrics with our complete NPS template + calculator.

Template

Eight templates to lead your new customers through their first several months with your product or service.

Guides

See how Sam Parr trained ChatGPT to become his advisor on everything from revenue optimization to life decisions.

Guides

Hear from experts, leaders and Millennials on their own coming-of-age story and what actually drives Millennials ...

Guides

Say what you mean, sound like a pro, and get people on your side with words that work.

Ebook

A report featuring data from over 1,000+ marketers packed with insights for 2025 on the ever-evolving AI landscape.

Tool

See how visible your brand is in AI-powered search engines.

Ebook

Unlock unprecedented efficiency with human-AI partnerships that deliver measurable results.

-1.jpg?width=3580&height=3198&name=Brandon%20(3)-1.jpg)

Content Strategy

This Forbes 30 Under 30 entrepreneur and former Head of Content at Kickstarter has shared his strategies and tips with the masses. Published in Hypebeast, AdAge, Complex, Highsnobiety, and AdWeek.

Productivity & Automation

Founder of Ms. Anti Work and TEDx speaker focused on helping people break burnout-inducing work habits. Published in The New York Times, BBC, The Wall Street Journal, 60 Minutes, and HubSpot.

Marketing & Branding

Founder & CEO of Ruth, a career platform focused on closing the gender wage gap with tools that help women build personal brands, negotiate salaries, and navigate careers with confidence.

Build a LinkedIn content sales engine that attracts leads, establishes trust, and drives revenue through intentional, strategic content creation and repurposing.

Showing 1 - 7 of 7

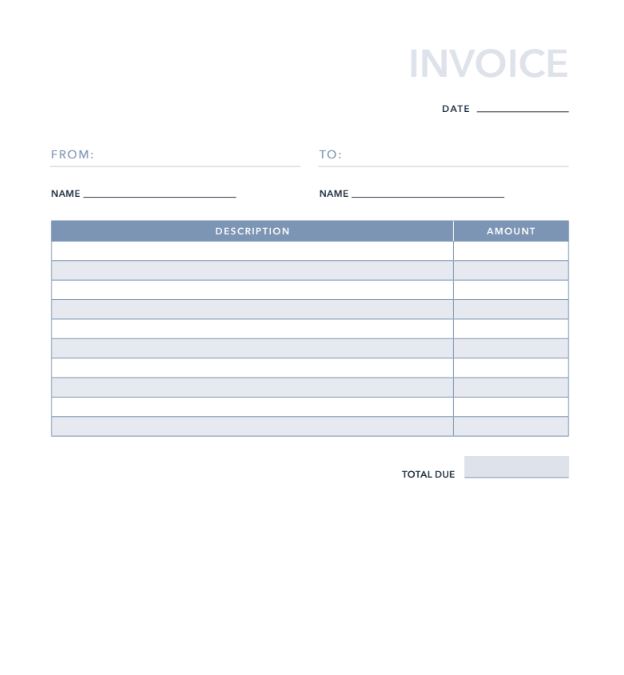

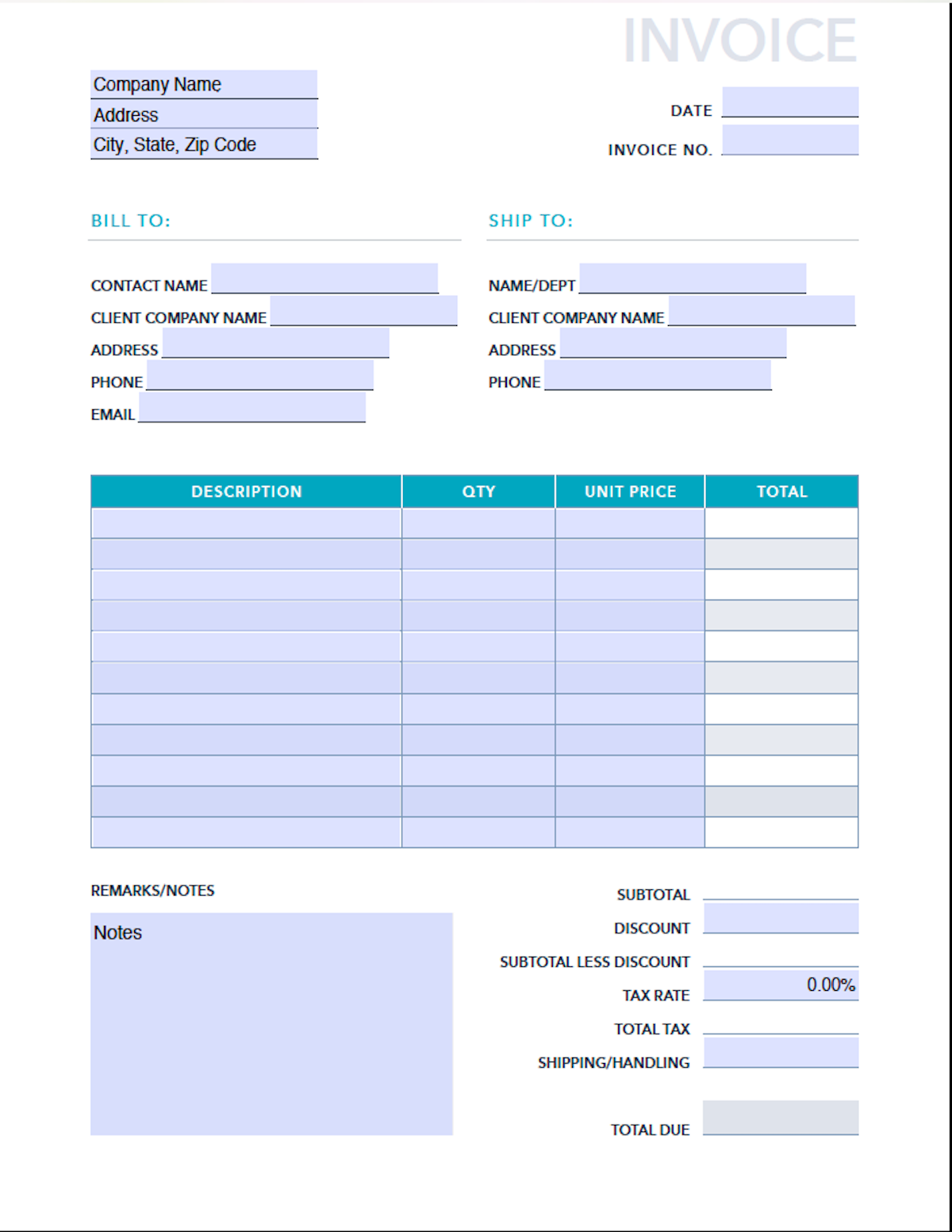

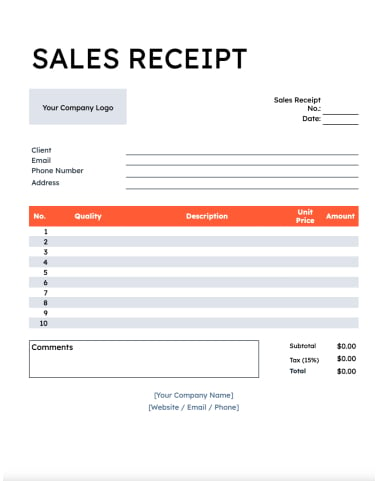

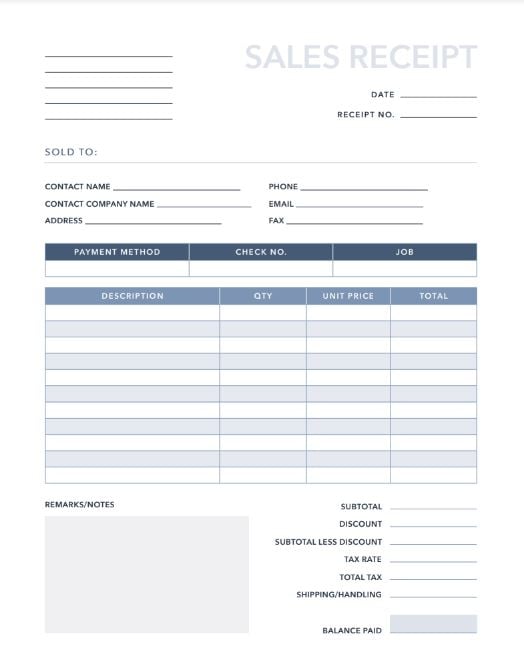

Template

Excel

Template

Excel

Template

Excel

Template

Excel

Template

Excel

Template

Excel

Template

Excel

Template

Excel

Template

Excel

Template

Excel

Template

Excel

Template

Excel

Template

Excel

Template

Excel

No Results

Found the resources you need? Take the next step. Start unifying your customer data today with an easy-to-use, AI-powered free CRM that works as hard as you do.

With HubSpot's CRM, your customer database is accessible to both sales and marketing teams to generate and nurture new prospects. Keep all your information up-to-date and at your fingertips to increase conversion rates and turn insights into results.